Why Fidelity is a top choice for retirement investors

Get to know Fidelity and understand how it is one of the options for long-term investors

Choosing a home for your retirement savings is one of the most significant financial decisions you’ll ever make. This isn’t just another account; it’s your nest egg, the product of decades of hard work. It needs to be safe, it needs to grow, and it needs to be with a company you can trust for the long haul.

In the crowded field of brokerage firms, three names consistently rise to the top: Fidelity, Schwab, and Vanguard. While all are excellent, Fidelity has deliberately engineered its platform with features that are uniquely beneficial for the long-term, buy-and-hold retirement investor.

From groundbreaking zero-fee funds to consumer-friendly cash management and robust planning tools, Fidelity has built an ecosystem designed to maximize your returns and minimize your stress.

If you’re opening your first IRA, rolling over an old 401(k), or managing a multi-million dollar nest egg, here is a deep dive into why Fidelity stands out as a top-tier choice for your retirement.

The Low-Cost Revolution: How Fidelity Saves You Real Money

For a retirement investor, your single greatest enemy isn’t a market crash—it’s fees. A seemingly tiny 1% annual fee can devour over 25% of your potential nest egg over a 40-year career. This is where Fidelity truly shines.

While all major brokers now offer $0 commissions on stock and ETF trades, that’s just the appetizer. The real cost lies in the expense ratios of the funds you hold.

Fidelity ZERO®: The 0.00% Expense Ratio

This is, without a doubt, Fidelity’s single biggest differentiator. In 2018, Fidelity launched a line of mutual funds with a 0.00% expense ratio.

This is not a typo. It’s not a temporary teaser rate. They charge you nothing to manage these funds.

The core funds in this lineup are:

- Fidelity ZERO® Total Market Index Fund (FZROX): Gives you exposure to the entire U.S. stock market.

- Fidelity ZERO® International Index Fund (FZILX): Gives you exposure to thousands of stocks across the developed and emerging international markets.

- Fidelity ZERO® Large Cap Index Fund (FNILX): Focuses on the S&P 500.

- Fidelity ZERO® Extended Market Index Fund (FZIPX): Focuses on mid- and small-cap U.S. stocks.

For a retirement investor building a simple, diversified portfolio, you can literally own the entire world’s stock market for a blended expense ratio of 0.00%.

How does this compare? Vanguard’s equivalent Total Stock Market fund (VTSAX) is legendary for being cheap, but it still charges 0.04%. Schwab’s (SWTSX) charges 0.03%. While these are incredibly low, they aren’t zero. Fidelity is playing a different game. They use these 0% funds as a “loss leader” to bring you into their ecosystem, and it’s an offer that is mathematically impossible to beat.

A Smarter Default: Why Fidelity’s Cash Sweep Account Matters

This is a more advanced topic, but it reveals a company’s true colors. A “cash sweep” is the default account where your uninvested cash sits—money from dividends, new deposits, or sales that you haven’t reinvested yet.

- Most Brokers: Many competitors, including Schwab, automatically “sweep” your cash into a low-yield, FDIC-insured bank account. In a high-interest-rate environment, they might be earning 5% on your cash from their banking partners while paying you a paltry 0.10%. They are profiting heavily from your inertia.

- Fidelity’s Approach: Fidelity does the opposite. By default, it sweeps your uninvested brokerage and IRA cash into the Fidelity Government Money Market Fund (SPAXX).

A money market fund (MMF) is not an FDIC-insured bank account, but it is an extremely safe, liquid investment (protected by SIPC) that invests in high-quality government debt. Its yield moves in lockstep with the Federal Reserve’s interest rates.

Why does this matter?

Imagine you have $20,000 in uninvested cash sitting in your account.

- At a competitor paying 0.10% APY, you’d earn $20 a year.

- At Fidelity, with SPAXX yielding 4.95% APY, you’d earn $990 a year.

That $970 difference is pure, passive profit that Fidelity chooses to give to you instead of keeping for itself. This single, pro-consumer decision demonstrates a core philosophy that aligns perfectly with the goals of a retirement saver.

One Home for All Your Accounts: IRA, Roth, and 401(k) Rollovers

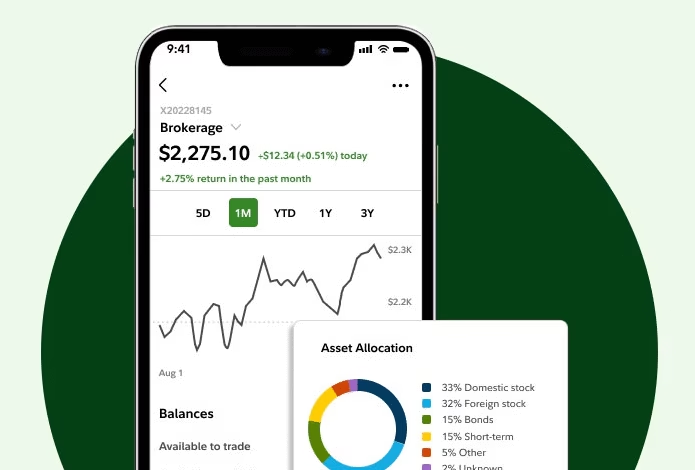

A retiree’s financial life is rarely just one account. You have old 401(k)s from previous jobs, a Traditional IRA, a Roth IRA, and maybe even a taxable brokerage account. Fidelity’s strength is its ability to be a “one-stop shop” for all of them.

Seamless 401(k) Rollovers

Changing jobs is a normal part of a long career, but it leaves a trail of forgotten 401(k) accounts. Consolidating them into a single Rollover IRA is one of the best ways to simplify your financial life. Fidelity makes this process incredibly easy. Their online tools and dedicated rollover specialists can walk you through the entire process, from contacting your old provider to getting the funds moved over, all with no fees.

The Best-in-Class Health Savings Account (HSA)

This is a hidden gem for retirement planning. A Health Savings Account (HSA) is arguably the most powerful retirement tool in existence, offering a “triple tax-advantage”:

- Contributions are tax-deductible.

- Money grows 100% tax-free.

- Withdrawals for qualified medical expenses are 100% tax-free.

Many HSA providers are small, clunky, and charge high monthly fees with terrible investment options. Fidelity’s HSA is widely considered the best in the industry.

- $0 fees to open or maintain the account.

- No “cash minimums”—you can invest every dollar.

- Access to Fidelity’s entire universe of investments, including the ZERO-fee funds.

You can use an HSA to pay for medical bills today, or you can use it as a “stealth IRA”—paying for medical expenses out-of-pocket and letting your HSA grow tax-free for 30 years to pay for healthcare in retirement. Fidelity is one of the only major brokers that provides this top-tier tool.

Planning Your Future: Fidelity’s Powerful Retirement Tools and Research

Fidelity isn’t just a place to hold money; it’s a resource to plan your future. For investors who want to be hands-on, their platform is a data powerhouse.

- Free, In-Depth Research: You get full access to professional, third-party research reports from firms like Morningstar, Argus, and CFRA. This can help you analyze stocks, ETFs, and mutual funds far beyond the basic stats.

- The Retirement Score Tool: This is a simple, intuitive feature that asks for your age, income, and savings, and gives you a single “score” showing if you’re on track for retirement. It’s a fantastic, at-a-glance motivator.

- Advanced Planning Calculators: For those who want to dig deeper, their “Planning & Guidance Center” is a full-fledged financial planning engine. You can model different scenarios: What if I retire at 62 instead of 67? What if inflation is higher? How do I plan for long-term care costs? This is the kind of robust planning that financial advisors charge thousands for, and it’s available for free.

A “Supermarket” of Investments: Beyond Just Fidelity Funds

While the 0% fee funds are a great starting point, your retirement account needs flexibility. Fidelity is an “open” platform, meaning it’s a giant supermarket of investments.

- Mutual Funds: Fidelity offers access to thousands of mutual funds from other companies (like PIMCO, T. Rowe Price, etc.) with no transaction fees (NTF).

- ETFs: You can buy virtually any ETF from any provider (like Vanguard’s VTI, Schwab’s SCHD, or iShares’ IVV) for a $0 commission.

- Stocks: Full access to U.S. and international stocks.

- Fixed Income: A robust marketplace for individual bonds, CDs, and U.S. Treasuries, which are critical for retirees seeking stable income.

This “open” architecture means you’ll never be “stuck” with only Fidelity’s products. You have the freedom to build any portfolio you want.

Talk to a Human: The Value of Robust Customer Service

In an age of faceless fintech apps and chatbot-only support, the value of robust customer service cannot be overstated. When you have a complex question about a 401(k) rollover or a required minimum distribution (RMD), you want to talk to a knowledgeable human.

Fidelity excels here:

- 24/7/365 Phone Support: You can get a licensed representative on the phone at any time of day or night.

- Secure Online Chat: Their online chat is fast, secure, and staffed by professionals.

- Local Investor Centers: Fidelity has a network of over 200 physical branches across the United States. You can schedule a free, in-person consultation to review your plan, which provides immense peace of mind for many investors.

This “hybrid” approach—great tech backed by real humans—is ideal for retirement investors who value both convenience and security.

How Does Fidelity Compare to Vanguard and Schwab?

To be fair, Fidelity’s main competitors are not bad choices. They are all excellent. The “best” one often comes down to small, but important, differences.

- Fidelity vs. Vanguard: Vanguard is the father of low-cost indexing and is beloved for its unique investor-owned structure. However, its technology and website are often seen as clunky and outdated. Fidelity offers the same (or lower, with 0%) costs but packages them in a much more modern, user-friendly, and feature-rich platform.

- Fidelity vs. Schwab: This is a much closer race. Both are full-service giants with great tech, $0 commissions, and excellent research. The two biggest differentiators are Fidelity’s ZERO-fee funds (Schwab has no 0.00% equivalent) and the cash sweep (Fidelity’s SPAXX is vastly superior to Schwab’s default bank sweep). For these two reasons, Fidelity often gets the edge for the pure, long-term investor.

Are There Any Downsides to Using Fidelity?

No platform is perfect. To present a balanced view, here are a few considerations:

- “Busy” Interface: For a brand-new investor, the Fidelity website can be overwhelming. There are so many tools, charts, and research articles that it can be harder to navigate than a simple, mobile-first app like Robinhood or SoFi.

- Payment for Order Flow (PFOF): Like Schwab and Robinhood, Fidelity accepts Payment for Order Flow. This means they route your stock trades to high-frequency trading firms (market makers) in exchange for a small payment. For a long-term retirement investor who makes a few trades a year, this is a non-issue. For a day trader, it can be a concern.

- Core Fund Costs: While their ZERO funds are free, some of their other standard index funds (like their S&P 500 fund, FXAIX) have an expense ratio of 0.015%. This is still incredibly low, but it’s not 0.00%, and it’s slightly higher than Schwab’s equivalent (SWPPX) at 0.01%.

Is Fidelity the Right Broker for Your Nest Egg?

When you stack it all up, Fidelity has built a platform that seems tailor-made for the modern retirement investor.

They hit every major checkpoint:

- Rock-Bottom Costs: The 0.00% expense ratio funds are unbeatable.

- Consumer-First Policies: The high-yield cash sweep (SPAXX) is a clear sign they put customer interests first.

- All-in-One Power: The ability to manage your IRAs, 401(k) rollovers, and a best-in-class HSA in one place is a massive convenience.

- World-Class Support: The combination of 24/7 service and physical branches provides peace of mind.

While other brokers do many things well, none seem to combine all of these powerful, pro-consumer features under one roof as effectively as Fidelity. For anyone serious about building wealth for the long term, Fidelity isn’t just a good choice—it’s an exceptional one.