What are the best brokers for Day Trading?

Find out which are the best brokers for day trading

Day trading, the practice of buying and selling financial instruments within the same trading day, can be a fast-paced and potentially profitable endeavor. However, success in day trading heavily relies on having the right tools and, crucially, the right broker. Choosing the best broker for your needs can significantly impact your trading costs, execution speed, available instruments, and overall trading experience. This article will guide you through the top brokers for day trading, highlighting their key features and helping you make an informed decision.

Low Commission Brokers for Active Traders: Minimizing Your Costs

For frequent day traders, commission costs can quickly eat into potential profits. Therefore, selecting a broker with low or zero commission fees is often a top priority.

- Interactive Brokers: Widely recognized for its incredibly low fees and extensive market access, Interactive Brokers is a favorite among professional and active traders. They offer tiered pricing structures that can result in very low per-share or fixed-rate commissions. Their platform, while powerful, can have a steeper learning curve for beginners.

- TD Ameritrade (now part of Charles Schwab): While TD Ameritrade was known for its thinkorswim platform (now integrated with Schwab), Charles Schwab also offers commission-free trading for stocks and ETFs. Thinkorswim remains a robust platform with advanced charting tools and analysis capabilities suitable for day trading.

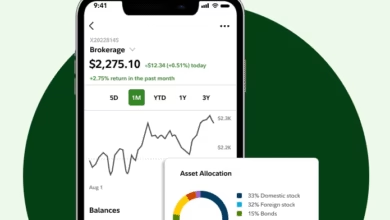

- Webull: Popular among newer traders, Webull offers commission-free trading on stocks, ETFs, and options. Its user-friendly mobile and desktop platforms are well-designed and provide real-time data and basic charting tools.

- Robinhood: Known for its simple and intuitive mobile-first platform, Robinhood also offers commission-free trading on stocks, ETFs, and options. However, it’s essential to be aware of their order execution practices, as they have faced scrutiny in the past.

Fast Execution and Direct Market Access: Crucial for Day Trading

In the world of day trading, milliseconds can make a difference. Brokers offering fast execution speeds and direct market access (DMA) can provide a significant edge.

- Lightspeed Trading: Catering to professional traders, Lightspeed offers direct market access and advanced order routing capabilities, resulting in very fast execution speeds. Their platform is highly customizable but comes with a monthly fee.

- Sterling Trader Pro: Another platform favored by professionals, Sterling Trader Pro provides direct access to exchanges and sophisticated order types designed for speed and precision. It typically involves per-share or per-contract commission structures.

Advanced Trading Platforms and Tools: Gaining a Technical Edge

A powerful trading platform equipped with advanced charting tools, technical indicators, real-time data feeds, and customizable layouts is essential for effective day trading.

- thinkorswim (Charles Schwab): As mentioned earlier, thinkorswim is a comprehensive platform offering a vast array of charting tools, technical indicators, paper trading capabilities, and educational resources.

- TradeStation: TradeStation provides a robust platform with advanced charting, backtesting capabilities, and the ability to automate trading strategies. They offer various commission structures.

- MetaTrader 5: A widely used platform globally, MetaTrader 5 offers advanced charting, algorithmic trading capabilities (Expert Advisors), and a wide range of technical indicators. Many brokers offer access to this platform.

Margin and Leverage for Day Traders: Amplifying Potential Returns (and Risks)

Margin accounts allow day traders to borrow funds from their broker to increase their trading capital, potentially amplifying both gains and losses.

- Most of the brokers mentioned above offer margin accounts to eligible traders. It’s crucial to understand the risks associated with margin trading, including the potential for significant losses exceeding your initial investment. Be aware of margin interest rates and margin call rules.

Regulation and Security: Ensuring the Safety of Your Funds

Choosing a regulated and reputable broker is paramount to protect your capital. Ensure the broker is regulated by a recognized financial authority in your jurisdiction (e.g., SEC in the United States, FCA in the UK).

- All the brokers listed are regulated entities. Always verify the regulatory status of any broker you are considering.

Factors to Consider Before Choosing a Broker: Your Individual Needs

The “best” broker ultimately depends on your individual trading style, capital, experience level, and specific needs. Consider the following:

- Your Trading Style: Are you a scalper making numerous trades per day, or do you focus on fewer, higher-probability setups?

- Your Budget: What is your initial capital? Be mindful of minimum account requirements.

- Your Experience Level: Are you a beginner or an experienced trader? Some platforms are more user-friendly than others.

- Available Instruments: Do you plan to trade stocks, options, futures, forex, or cryptocurrencies? Ensure the broker offers the instruments you are interested in.

- Customer Support: Responsive and knowledgeable customer support can be crucial, especially when dealing with time-sensitive trading issues.

Finding the Right Fit for Your Day Trading Journey

Selecting the right broker is a critical step in your day trading journey. By carefully evaluating factors such as commission fees, execution speed, platform features, margin availability, and regulatory compliance, you can choose a partner that aligns with your trading goals and helps you navigate the dynamic world of day trading with greater confidence. Remember to conduct thorough research and potentially paper trade (practice with virtual money) on a platform before committing real capital.