How to rebalance your investments in December

Learn how to rebalance your investments at the end of the year

December is a time for reflection. We look back at the year, review our budgets, and set goals for the new one. But while you’re checking your holiday gift list, there’s one critical financial task most people forget: checking their investment portfolio.

After a long year in the market, your investments have almost certainly “drifted.” The mix of assets you so carefully chose is likely out of whack, and with it, the level of risk you’re exposed to.

This is where rebalancing comes in.

It sounds like a complex term, but it’s one of the most important, disciplined actions you can take to protect your long-term wealth. It’s the “boring” secret that separates successful investors from emotional ones.

This guide will break down exactly what rebalancing is, why December is the perfect time to do it, and how you can get it done in your 401(k), IRA, and brokerage accounts—even if you’re a complete beginner.

What Does ‘Rebalancing Your Portfolio’ Actually Mean?

Let’s use a simple analogy. Think of your investment plan as a recipe.

When you started investing, you and your advisor (or your own research) decided on a recipe that matched your goals and risk tolerance. Maybe it was a “moderate” recipe:

- 60% Stocks (the “growth” ingredients)

- 40% Bonds (the “stability” ingredients)

This 60/40 mix is your Target Asset Allocation. It’s designed to give you good growth potential (from stocks) while providing a cushion (from bonds) to protect you during a market crash.

Now, let’s say you invested $10,000 using this recipe: $6,000 in stocks and $4,000 in bonds.

Over the next year, the stock market has a fantastic run, and your stocks grow by 20%. Your bonds, being the stable ingredient, only grew by 2%.

- Your $6,000 in stocks is now worth $7,200.

- Your $4,000 in bonds is now worth $4,080.

- Your total portfolio is now worth $11,280.

Here’s the problem:

- Your stocks now make up 63.8% of your portfolio ($7,200 / $11,280).

- Your bonds now make up only 36.2% of your portfolio.

Your 60/40 recipe has “drifted” to a 64/36 recipe. You are now taking on more risk than you originally planned. If the market were to crash, you’d be hit harder than you were comfortable with.

Rebalancing is simply the act of restoring your original recipe.

In this case, you would sell some of your over-performing stocks (the “growth” ingredient that expanded) and use that money to buy more of your under-performing bonds (the “stability” ingredient). This brings you back to your 60/40 target, locking in some gains and reducing your risk.

Why Rebalancing Is the Most Important Financial Task You’re Not Doing

Most investors get this backward. They let their emotions drive. When stocks are “hot,” they want to buy more (FOMO, or “Fear of Missing Out”). When stocks crash, they want to sell everything (Panic).

Rebalancing is a disciplined system that forces you to do the exact opposite. It is the physical mechanism for obeying the #1 rule of investing: “Buy low, sell high.”

1. It Automates “Sell High, Buy Low”

When you rebalance, you are systematically selling the assets that have performed well (selling high) and systematically buying the assets that have performed poorly or grown less (buying low). You’re taking profits from your winners and reinvesting them into the “on sale” parts of your portfolio. This removes all emotion from the equation.

2. It Manages Your True Risk Tolerance

This is the most important reason. That 60/40 “recipe” wasn’t chosen at random. It was based on your age, your goals, and your “sleep-at-night” factor. If you let your portfolio drift to 70/30 or 80/20 because stocks are doing well, you are no longer a “moderate” investor. You are an “aggressive” investor, and you may not realize it until the next major market downturn.

When that crash comes, the 80% stock portfolio will fall much harder, and you will be far more likely to panic-sell at the bottom, locking in devastating losses. Rebalancing is your seatbelt. It keeps you from flying through the windshield when the market hits a pothole.

3. It Instills Discipline

Wealth is built on systems, not feelings. Having a plan to rebalance (e.g., “every December”) creates a non-negotiable financial habit. It’s like an annual physical for your money. It forces you to look under the hood, make small adjustments, and stay on course for the long term.

Why December Is the Perfect Time for a Portfolio Check-Up

You can rebalance at any time, but doing it in December has several distinct advantages that make it a “power move” for savvy investors.

1. The “New Year, New Me” Mindset

The end of the year is a natural time to review everything. You’re already thinking about your 2026 budget, your career goals, and your New Year’s resolutions. Adding a “portfolio review” to this list is a natural fit. It allows you to close the books on the current year and start the next one with a clean, balanced slate.

2. The Tax-Harvesting Superpower (Tax-Loss Harvesting)

This is the single biggest reason to rebalance in December. This strategy applies only to your taxable brokerage accounts (not your 401(k) or IRA).

Here’s how it works:

- As part of rebalancing, you may be selling “winners” that have grown a lot. This creates a capital gain, which you will have to pay taxes on.

- To offset this, you can look for any “losers” in your portfolio—investments that are currently worth less than you paid for them.

- You can sell those losers and “harvest” the capital loss.

This harvested loss is financial gold. It can be used to:

- Offset your capital gains: If you have $3,000 in gains from selling winners and $3,000 in losses from selling losers, they cancel each other out. You pay $0 in taxes on that gain.

- Offset your regular income: If your losses are greater than your gains, you can use up to $3,000 of that leftover loss to reduce your taxable income from your job. This is a direct tax deduction.

The Wash Sale Rule: A CRITICAL Warning

You cannot just sell a stock for a loss and buy it right back. The IRS forbids this. The Wash Sale Rule states that you cannot claim a tax loss if you buy the same or a “substantially identical” security within 30 days (before or after) the sale.

- Example: You can’t sell Ford stock for a loss and buy Ford stock back a week later. You could sell Ford and buy GM (a different, non-identical company in the same sector). Or you could sell an S&P 500 ETF from one company (like VOO) and buy an S&P 500 ETF from another (like SPY), though even this is a gray area. The safest bet is to wait the full 31 days or buy a distinctly different asset.

3. Year-End Bonus and Contribution Planning

Many people receive a year-end bonus in December. This new cash provides a perfect opportunity to rebalance without selling. Instead of selling your “winning” stocks, you can use 100% of your new bonus money to buy your “losing” or under-performing assets (like bonds) until your original recipe is restored. We’ll cover this in more detail below.

A Step-by-Step Guide: How to Rebalance Your 401(k), IRA, and Brokerage Accounts

This is the “how-to” part. Don’t be intimidated. Most retirement platforms make this incredibly easy.

Step 1: Find Your Original “Recipe” (Target Allocation)

Log into your retirement account. What was your original plan? If you don’t have one, this is your first task (a good rule of thumb for beginners is “110 minus your age in stocks,” but this is not advice).

If you’re in a Target-Date Fund (e.g., “Retirement 2050 Fund”), guess what? You don’t need to do anything. These funds rebalance automatically for you. That’s their primary benefit!

But if you picked your own funds (e.g., 50% US Stock Fund, 20% International Stock Fund, 30% Bond Fund), then you have a target. Let’s use that 70/30 (stocks/bonds) mix as our example.

Step 2: See What You Have Now (Current Allocation)

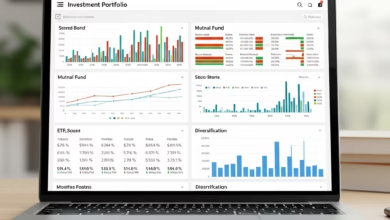

Log into your 401(k) or IRA. Most dashboards have a “pie chart” or “allocation” tool that shows you your current mix.

Let’s say your target is 70% Stocks / 30% Bonds.

But after a good year for stocks, your dashboard now shows you have 82% Stocks / 18% Bonds.

You are significantly “overweight” in stocks and are taking on far more risk than you intended. It’s time to rebalance.

Step 3: Choose Your Rebalancing Method

You have two primary ways to fix this, and your choice depends on where the money is.

Method A: The Classic “Sell-to-Buy” (Best for 401(k)s and IRAs)

This is the simplest method and is perfect for tax-advantaged accounts.

- Log in: Go to your 401(k) or IRA provider’s website.

- Find the “Rebalance” Button: Most platforms (like Fidelity, Vanguard, Schwab) have a literal button that says “Rebalance” or “Exchange Funds.”

- Set Your Targets: You will tell the system your desired allocation (70% Stocks, 30% Bonds).

- Click “Submit”: The system will automatically calculate and execute the trades for you. It will sell the exact amount of your stock funds and use the proceeds to buy your bond funds to get you back to 70/30.

The best part? Because this is all happening inside a 401(k) or IRA, it is a 100% tax-free event. You will not pay any capital gains taxes. This is why you should always try to rebalance within your retirement accounts first.

Method B: The “New Money” Method (Best for Taxable Brokerage Accounts)

Let’s say your taxable brokerage account (not your IRA) is the one that’s out of balance. If you use Method A, you’ll be selling your “winning” stocks and triggering a capital gains tax bill.

We can avoid this.

- Check Your Allocation: You see you are 82% stocks and 18% bonds.

- Redirect New Money: You have a year-end bonus of $5,000, OR you have your regular $500/month contribution.

- The Action: Instead of investing that new money across your usual 70/30 split, you allocate 100% of your new money to your under-performing asset (bonds).

- You continue to only buy bonds with new money until your portfolio “drifts” back to your 70/30 target.

This method is incredibly powerful. It allows you to rebalance your portfolio using new contributions without ever selling a single share and without paying a cent in capital gains tax.

How to Rebalance Without Causing a Huge Tax Bill (A Deeper Dive)

This is so important it deserves its own section. A surprise tax bill in April can wipe out the psychological benefit of rebalancing. Here is your priority list for “smart” rebalancing:

- First, Rebalance Inside Your 401(k) and IRA. As we covered, this is a tax-free event. Your 401(k) and IRA are “tax shelters.” Use them. This should be your first and easiest move.

- Second, Use New Contributions. If your taxable account is still out of balance, use the “New Money” method. This is the preferred way to rebalance a taxable account.

- Third, If You Must Sell, Harvest Losses. If you have no new money and your portfolio is dangerously out of balance, you’ll have to sell. This is where you pair your “winners” with your “losers.” Sell your high-flying stock for a $5,000 gain, then sell that disappointing stock for a $4,000 loss. You now only have a $1,000 taxable gain.

- Fourth, Prioritize Long-Term Gains. If you have to sell a winner, try to sell shares you have held for more than one year. These are “long-term capital gains” and are taxed at a much lower rate (0%, 15%, or 20%) than “short-term gains” (held less than one year), which are taxed as your ordinary income.

Are You Making These Common Rebalancing Mistakes?

Getting this wrong can be costly. Avoid these common pitfalls.

- Mistake #1: Rebalancing Too Often.Don’t rebalance every week or every month. This is “tinkering,” not investing. For most people, once a year (like in December) is perfect. Some people do it “by percentage” (e.g., “I’ll rebalance any time an asset class is 5% off its target”). Both are fine. Just don’t overdo it.

- Mistake #2: Letting Emotions Win.The whole point of this is to remove emotion. You will look at your “hot” tech fund and your brain will scream, “DON’T SELL THAT! It’s a winner!” You must ignore this feeling. Trust the system. The recipe is the recipe for a reason.

- Mistake #3: Forgetting About It Entirely.This is the most common mistake. A 30-year-old might start with an 80/20 portfolio. By the time they are 45, it may have drifted to 95/5. They are unknowingly taking on the risk of a 25-year-old, right when they should be getting more conservative.

- Mistake #4: Ignoring Fees.Check if your funds have “transaction fees” or “load fees” for buying and selling. Most modern ETFs and mutual funds don’t, but it’s crucial to check.

- Mistake #5: Misunderstanding the Wash Sale Rule.Seriously, be careful. If you sell a fund for a loss to harvest it, do not buy it back in your IRA the next day. The IRS may see this as a “wash” across all your accounts. Talk to a tax pro if you are doing complex harvesting.

Beyond Rebalancing: Your 3-Point Year-End Investment Checklist

While you’re under the hood, you might as well check a few other things. Add these to your December financial review.

- Review Your Contributions. Are you maxing out your 401(k)? Your IRA? The contribution limits are likely increasing for 2026. This is the time to plan to increase your payroll deduction for January.

- Check Your Beneficiaries. This is a 10-second check that can save your family a lifetime of legal pain. Log into your 401(k), IRA, and life insurance policies. Is the listed beneficiary still correct? An ex-spouse still listed on an old 401(k) is a financial catastrophe waiting to happen.

- Review Your Overall Risk Tolerance. Rebalancing brings you back to your old recipe. But is that recipe still right for you? If you got married, had a child, or are now 5 years away from retirement instead of 10, your entire “recipe” might need to change (e.g., from 70/30 to 60/40). December is the perfect time to make this strategic change before you rebalance.

Your Fresh Start for 2026

Rebalancing is not a “sexy” investment strategy. It’s not about finding the next hot stock. It’s the quiet, disciplined, and “boring” work that builds real, sustainable wealth.

By taking an hour this December to review your portfolio, you are doing what most people won’t: you are choosing logic over emotion. You are locking in gains, managing your risk, and setting yourself up for a successful new year.

Don’t let your hard-earned money drift into a high-risk gamble. Take control, restore your recipe, and enter 2026 with the confidence that comes from having a plan.