Discover the best finance books for beginners

Discover the best financial literacy books for beginners

For the modern freelancer, independence is the ultimate reward. The ability to choose your clients, set your hours, and work from anywhere in the world is a dream for many. However, this freedom comes with a significant catch: you are your own CFO.

Unlike traditional employees, the self-employed don’t have a HR department to handle tax withholdings, a boss to provide a 401(k) match, or a steady, predictable paycheck that arrives every two weeks. The “feast or famine” cycle is a real threat, and without a solid financial education, even a high-earning freelancer can find themselves struggling to keep up with quarterly taxes and retirement savings.

To help you navigate these waters, we have curated a list of the absolute best financial education books tailored specifically for the unique needs of the self-employed. These titles don’t just teach you how to save; they teach you how to build a resilient business.

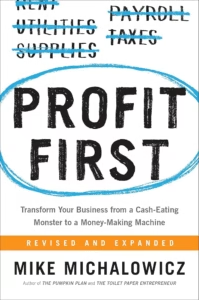

1. Mastering Cash Flow Management: Why “Profit First” is a Freelancer’s Bible

One of the biggest mistakes freelancers make is treating their business bank account like a personal piggy bank. Mike Michalowicz’s “Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine” addresses this head-on.

The Behavioral Science of the “Small Plates” Method

Michalowicz argues that traditional accounting (Sales – Expenses = Profit) is flawed because it treats profit as an afterthought. Instead, he proposes a system based on human behavior. By taking your profit first and allocating the remainder to expenses, you force your business to become more efficient.

For a freelancer, this means setting up separate accounts for:

-

Income (Where all client payments land)

-

Profit (Your reward for the risk of being self-employed)

-

Owner’s Pay (Your “salary”)

-

Taxes (The government’s share)

-

Operating Expenses (The cost of running your business)

This book is essential because it eliminates the “bank balance accounting” trap—where you see $5,000 in your account and think you’re rich, forgetting that $1,500 belongs to the IRS and $1,000 is for next month’s software subscriptions.

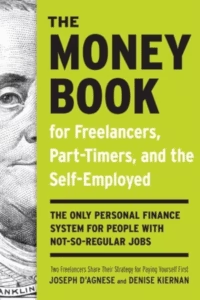

2. Navigating the Variable Income Trap: “The Money Book for Freelancers”

If you are looking for a book that specifically understands the 1099 life, look no further than “The Money Book for Freelancers, Part-Timers, and the Self-Employed” by Joseph D’Agnese and Denise Kiernan.

Solving the “Feast or Famine” Cycle

The authors provide a step-by-step system for managing an income that changes every month. Their core philosophy revolves around the “Percentage System.” They teach you how to break down every check you receive into specific “buckets.”

This book is particularly helpful for laypeople because it avoids overly technical jargon. It treats your freelance career as a business, emphasizing the need for a “Safety Net” (emergency fund) and a “Long-Term Life” (retirement) fund. It is the practical manual for anyone who is tired of wondering if they can afford to take a vacation without a steady paycheck.

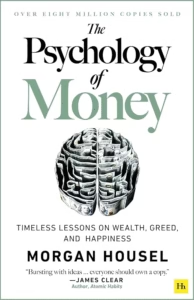

3. The Psychology of Wealth: Understanding Your Relationship with Money

Financial success is 20% head knowledge and 80% behavior. This is especially true when your income is tied directly to your personal output. “The Psychology of Money” by Morgan Housel is a masterpiece in understanding the “why” behind our financial decisions.

Why Logic Fails in Personal Finance

Housel explains that doing well with money isn’t necessarily about what you know. It’s about how you behave. For freelancers, who often experience the high-stress environment of looking for the next gig, emotional discipline is vital.

-

Staying Wealthy vs. Getting Wealthy: Housel argues that getting money requires taking risks, being optimistic, and putting yourself out there. Keeping money, however, requires the opposite: humility and a fear that what you’ve made can be taken away just as fast.

-

The Power of “Enough”: For the self-employed, the drive to constantly “scale” can lead to burnout. Housel helps readers define what “enough” looks like, ensuring that your business serves your life, rather than your life serving your business.

4. Building Scalable Systems: “The 4-Hour Workweek” and Financial Automation

While often categorized as a productivity book, Timothy Ferriss’s “The 4-Hour Workweek” is a fundamental text for modern freelance financial strategy. It introduced the concept of “Lifestyle Design” and the importance of separating time from money.

Geographic Arbitrage and Passive Income

Ferriss teaches freelancers how to maximize their “per-hour” value. From a financial perspective, the book is brilliant regarding:

-

Outsourcing: Spending money to buy back your time.

-

Automation: Setting up systems so your business generates revenue even when you aren’t at your desk.

-

The New Rich: Defining wealth not just by a dollar amount in the bank, but by the “mobility” and “time” you have to enjoy it.

For a freelancer, this book is a call to stop being a “glorified employee” of your clients and start being an owner of a scalable system.

5. Retirement for the Self-Employed: Advanced Lessons from “I Will Teach You To Be Rich”

Ramit Sethi’s “I Will Teach You To Be Rich” is a favorite for the younger generation of American freelancers. While it covers basics like credit cards and banking, its real value for the self-employed lies in its “Set It and Forget It” philosophy.

Automating the SEP IRA and Solo 401(k)

Sethi is a huge proponent of automation. He walks readers through how to set up automatic transfers so that your investments grow without you having to manually move money every month. For freelancers, he provides clarity on:

-

Choosing the right accounts: Understanding the tax advantages of a Solo 401(k) vs. a SEP IRA.

-

Negotiating fees: How to stop losing your wealth to high-expense ratio mutual funds.

-

Conscious Spending: Learning to spend extravagantly on the things you love while cutting costs mercilessly on the things you don’t.

6. Comparison of Financial Strategies for Freelancers

To help you decide which book to start with, here is a breakdown of their primary focus areas:

| Book Title | Primary Focus | Best For… |

| Profit First | Cash Flow / Accounting | Those who struggle with overspending in business. |

| The Money Book for Freelancers | Practical Logistics | Beginners transitioning from a W-2 to 1099. |

| The Psychology of Money | Behavioral Finance | Those who want to improve their financial mindset. |

| I Will Teach You To Be Rich | Automation / Investing | People looking for a “set-it-and-forget-it” system. |

| The 4-Hour Workweek | Efficiency / Lifestyle | Freelancers looking to scale and work less. |

7. The Importance of Tax Education for the Self-Employed

While books provide the strategy, you must also understand the “rules of the game.” In the US, the self-employed are hit with the Self-Employment Tax (currently 15.3%), which covers both the employer and employee portions of Social Security and Medicare.

Most of the books listed above emphasize the importance of “Tax Escrowing.” As a freelancer, you should ideally be saving 25% to 30% of every dollar you earn in a dedicated tax savings account. Failure to do this is the #1 reason why freelance businesses fail within the first three years. Reading these books will give you the discipline to treat the IRS as your most important “silent partner.”

8. Why Financial Literacy is the Ultimate Competitive Advantage

In the gig economy, your skill (graphic design, coding, writing, consulting) is only half of the equation. The other half is your ability to manage the capital that your skill generates.

A freelancer who earns $150,000 a year but has $0 in savings and high debt is in a much more precarious position than a freelancer who earns $70,000 but has a “Profit First” system, a fully funded emergency fund, and automated investments.

The Freedom to Say “No”

The greatest benefit of following the advice in these books is the power it gives you in the marketplace. When your finances are in order, you have “F-you Money.” This means you can say no to “nightmare clients,” no to low-paying gigs, and no to projects that don’t align with your values. Financial literacy is the foundation of professional integrity.

9. Your Reading Roadmap to Financial Freedom

If you are feeling overwhelmed, start small. Financial education is a marathon, not a sprint.

-

Month 1: Read Profit First and open your separate bank accounts.

-

Month 2: Read The Psychology of Money to understand your spending triggers.

-

Month 3: Read I Will Teach You To Be Rich to automate your retirement contributions.

By investing in these books, you are investing in the longevity of your career. Being self-employed doesn’t have to mean being financially unstable. With the right systems in place, you can enjoy the freedom of the freelance life with the security of a corporate executive.