Credit Card vs. Personal Loan: Which Is Better for Borrowing Money?

How to Decide Which Loan Method Works for You

When you need to access cash you don’t have on hand—whether it’s for an unexpected emergency, a major home renovation, or to consolidate high-interest debt—you’ll likely face a critical decision: should you use a credit card or take out a personal loan? Both are common financial tools that allow you to borrow money, but they function in vastly different ways.

Choosing the wrong one can cost you hundreds or even thousands of dollars in interest and fees, while the right choice can provide a manageable and cost-effective solution to your financial needs. But how do you know which path to take?

This comprehensive guide will break down the fundamental differences between credit cards and personal loans. We’ll explore their structures, interest rates, and ideal use cases, and provide a clear framework to help you decide which option is best for your specific situation. Making an informed choice is the first step toward responsible borrowing and long-term financial health.

What Is a Personal Loan and How Does It Work?

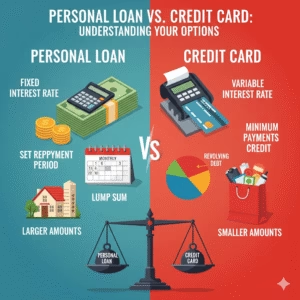

A personal loan is a type of installment credit. This means you borrow a fixed, lump-sum amount of money from a lender (like a bank, credit union, or online lender) and agree to pay it back in equal, regular installments (usually monthly) over a predetermined period, known as the loan term.

Key Characteristics of a Personal Loan:

- Fixed Amount: You receive the entire loan amount upfront. For example, if you’re approved for a $10,000 loan, that full amount is deposited into your bank account.

- Fixed Interest Rate: The vast majority of personal loans have a fixed Annual Percentage Rate (APR). This means your interest rate—and therefore your monthly payment—will not change for the entire life of the loan, making it easy to budget for.

- Fixed Repayment Term: Loan terms typically range from one to seven years. You’ll know from day one exactly how many payments you need to make and when your debt will be fully paid off.

- Unsecured Nature: Most personal loans are “unsecured,” meaning you do not have to put up any collateral (like your car or house) to qualify. Lenders approve you based on your creditworthiness, including your credit score and income.

Think of a personal loan as a structured, predictable borrowing method designed for a specific, one-time financial need.

How Do Credit Cards Function as a Borrowing Tool?

A credit card, on the other hand, is a form of revolving credit. Instead of a one-time lump sum, you are given a credit limit—a maximum amount you can borrow against. You can draw from this limit as needed, pay it back, and then borrow it again without having to reapply.

Key Characteristics of a Credit Card:

- Flexible Borrowing: You can use your card for multiple purchases of varying amounts, as long as you stay under your credit limit.

- Variable Interest Rates: Credit cards almost always have a variable APR that is tied to a benchmark rate, like the Prime Rate. This means your interest rate can—and likely will—change over time.

- No Fixed Repayment Term: Unlike a personal loan, there is no set end date for your debt. You are only required to make a minimum payment each month. If you only pay the minimum, it can take many years (and a huge amount of interest) to pay off your balance.

- Interest-Free Grace Period: Credit cards offer a grace period on new purchases. If you pay your statement balance in full by the due date, you will not be charged any interest on those purchases. This is a significant advantage that personal loans do not offer.

Think of a credit card as a flexible, open-ended line of credit best suited for ongoing or smaller expenses.

The Big Question: When Is a Personal Loan the Better Choice?

A personal loan generally shines when you have a large, specific expense and you value predictability and a clear path out of debt.

1. For Large, One-Time Expenses (e.g., Home Renovations, Medical Bills)

If you’re planning a kitchen remodel, facing a significant medical bill, or need to pay for a major wedding expense, a personal loan is often the superior choice. You can get the exact amount you need in one lump sum to pay contractors or providers. The fixed monthly payments make it easy to incorporate into your budget, and you’ll have a clear timeline for when the debt will be gone.

2. For Debt Consolidation with a Clear End Date

If you’re juggling multiple high-interest credit card balances, a personal loan can be a powerful debt consolidation tool. The process involves taking out a single personal loan to pay off all your credit card balances. The benefits are twofold:

- Lower Interest Rate: Personal loan APRs are often significantly lower than credit card APRs, especially if you have good credit. This can save you a substantial amount of money.

- Simplified Payments: You replace multiple monthly payments with a single, fixed payment, making your finances easier to manage. Most importantly, it converts your revolving debt into an installment loan with a finish line, forcing you to pay it off within the loan’s term.

3. When You Need a Large Amount of Cash

Personal loans typically offer higher borrowing amounts than credit cards. While a credit card limit might top out at a few thousand dollars for many people, personal loans can often be secured for $25,000, $50,000, or even more, depending on your credit and income.

Under What Circumstances Does a Credit Card Make More Sense?

A credit card is the ideal tool when you value flexibility, are dealing with smaller expenses, or can take advantage of the interest-free grace period.

1. For Smaller, Short-Term Expenses You Can Pay Off Quickly

Need to buy a new laptop, cover a minor car repair, or pay for an emergency plane ticket? A credit card is perfect for these situations. The process is instant—you just swipe or tap. If you can pay the balance off in full when the statement arrives, you’ve essentially gotten a short-term, interest-free loan. A personal loan would be overkill for these types of purchases due to the application process and minimum borrowing amounts.

2. For Ongoing or Unpredictable Expenses

If you’re facing expenses that are spread out over time—like a series of dental appointments or ongoing costs for a new business venture—a credit card offers the flexibility you need. A personal loan gives you all the money at once, which might not be practical. A credit card allows you to pay for things as the costs arise, drawing from your credit line only when necessary.

3. To Earn Rewards and Take Advantage of Purchase Protections

One of the biggest advantages of credit cards is the ecosystem of rewards. Whether it’s cashback, airline miles, or hotel points, using a credit card for planned expenses (that you can pay off immediately) allows you to get something back for your spending. Furthermore, credit cards offer robust consumer protections like purchase protection, extended warranty, and fraud liability that you don’t get with personal loans.

Head-to-Head Comparison: Credit Card vs. Personal Loan

| Feature | Personal Loan | Credit Card |

| Type of Credit | Installment Credit | Revolving Credit |

| How You Receive Funds | One lump-sum payment | A line of credit to draw from as needed |

| Interest Rate | Typically fixed | Typically variable |

| Repayment Structure | Fixed monthly payments over a set term | Variable payments (minimum due) with no set term |

| Typical APRs | 6% – 36% (lower for good credit) | 18% – 29% (often higher than personal loans) |

| Best For | Large, one-time expenses; debt consolidation | Small, short-term expenses; ongoing costs; earning rewards |

| Fees | May include an origination fee (1-8% of loan) | May include annual fees, late fees, cash advance fees |

| Interest-Free Period | No, interest accrues from day one | Yes, a grace period on new purchases if paid in full |

What About Cash Advances on a Credit Card?

A credit card cash advance allows you to withdraw cash from an ATM using your credit card. While it might seem like a quick fix, this is almost always the most expensive way to borrow money. Here’s why:

- Extremely High APRs: The APR for a cash advance is typically several percentage points higher than your regular purchase APR.

- No Grace Period: Interest begins to accrue the moment you withdraw the cash.

- Upfront Fees: You will be charged a cash advance fee, usually 3-5% of the amount withdrawn.

A personal loan is almost always a drastically cheaper and more financially sound option than a credit card cash advance.

Making Your Final Decision: Key Questions to Ask Yourself

To make the right choice, take a moment to honestly assess your situation by answering these questions:

- How much money do I need? For large amounts ($5,000+), a personal loan is often better. For smaller amounts, a credit card is more practical.

- What is the purpose of the funds? Is it a single, planned expense (loan) or a series of smaller, ongoing purchases (credit card)?

- How quickly can I pay it back? If you are 100% confident you can pay it off within a month or two, a credit card’s grace period is a huge advantage. If you need years to repay, the structure and lower rate of a personal loan are superior.

- How disciplined am I with my finances? A personal loan forces discipline with its fixed payments. A credit card requires self-discipline to pay more than the minimum and avoid letting the balance grow.

Ultimately, both credit cards and personal loans are powerful tools. The key is to match the right tool to the right job. By understanding their core differences and aligning them with your financial needs and habits, you can borrow money intelligently and stay in control of your debt.