Best Personal Finance Books for Millennials and Gen Z

Top Personal Finance Books Empowering Millennials and Gen Z to Build Wealth

Navigating the world of personal finance can feel overwhelming, especially for Millennials and Gen Z who are often juggling student loans, the gig economy, and a rapidly changing economic landscape. Fortunately, there’s a wealth of knowledge available in the form of personal finance books that can provide guidance and empower you to take control of your financial future. This article highlights some of the best personal finance books for young adults looking to master their money, learn smart investing strategies, and achieve financial independence.

Master Your Money: Essential Personal Finance Books for Young Adults

Building a solid financial foundation is crucial. These books offer practical advice on budgeting, saving, and understanding the basics of personal finance, making them excellent resources for those just starting their financial journey.

- “Broke Millennial Takes On Investing: A Beginner’s Guide to Leveling Up Your Money” by Erin Lowry: This book directly addresses the concerns and challenges faced by Millennials when it comes to investing. Lowry breaks down complex topics into easy-to-understand language, providing actionable steps for getting started with investing, even with limited funds. It’s a fantastic resource for millennial investment strategies and Gen Z investing for beginners.

- “The Total Money Makeover” by Dave Ramsey: While a classic, Ramsey’s principles of debt reduction and building wealth through his “snowball method” resonate strongly with younger generations burdened by debt. This book offers a straightforward, no-nonsense approach to debt management for Millennials and establishing a strong financial footing.

- “Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence” by Vicki Robin and Joe Dominguez:1 This book encourages a fundamental shift in how you view money and work. It guides readers through a process of understanding their relationship with money, reducing expenses, and ultimately achieving financial independence. It provides valuable insights for early financial independence for Gen Z and Millennial financial freedom.

Investing Wisdom for the Next Generation: Books to Grow Your Wealth

Once you have a handle on the basics, the next step is to make your money work for you through investing. These books offer valuable insights into different investment strategies and help you build long-term wealth.

- “The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life” by JL Collins: This book offers a straightforward and easy-to-follow approach to investing, primarily focusing on low-cost index funds. Collins’ writing style is clear and engaging, making it an excellent resource for simple investment strategies for Millennials and passive investing for Gen Z.

- “A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing” by Burton Malkiel: This classic investment book provides a comprehensive overview of market history and investment theories, arguing for a passive investment approach. Understanding these principles is crucial for making informed long-term investment decisions for both Millennial long-term investing and Gen Z wealth building.

- “I Will Teach You to Be Rich” by Ramit Sethi: This book offers a practical, six-week program to automate your finances, pay off debt, save money, and invest. Sethi’s direct and often humorous style makes complex financial topics accessible and engaging for a younger audience interested in automated finance for Millennials and Gen Z financial planning.

Beyond the Basics: Advanced Personal Finance and Mindset for Young Adults

These books delve into more nuanced aspects of personal finance, including behavioral economics and strategies for maximizing your earning potential.

- “The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness” by Morgan Housel: This book explores the often-overlooked psychological factors that influence our financial decisions. Understanding these biases can lead to better long-term financial outcomes for Millennial financial psychology and Gen Z behavioral finance.

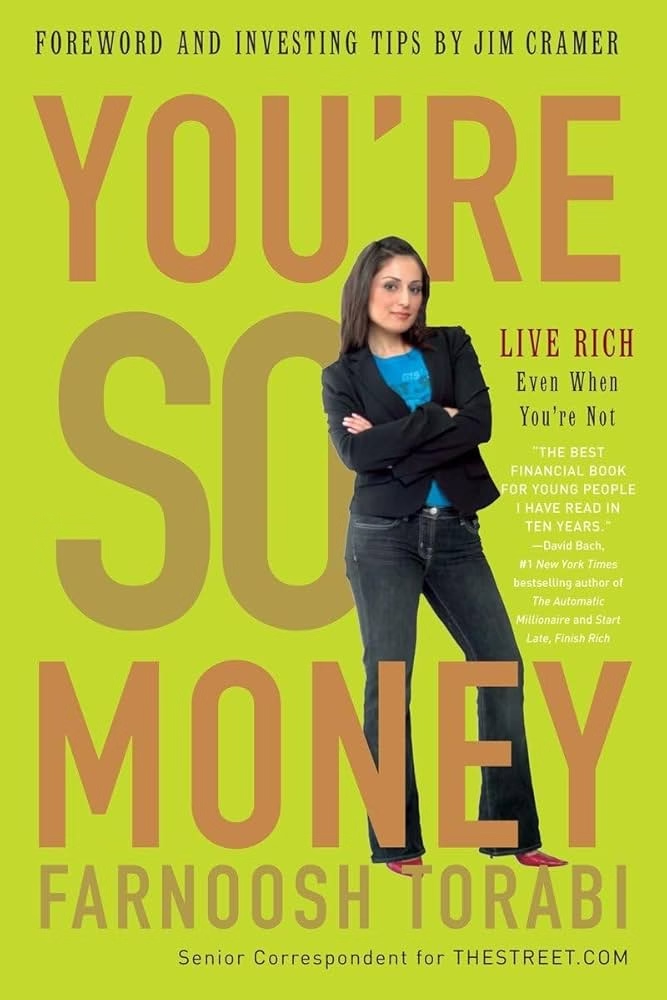

- “So Money: Live Richer, Even If You’re Not” by Farnoosh Torabi: Torabi offers practical advice on various aspects of personal finance, including negotiating salary, managing student loans, and building wealth. Her relatable style and actionable tips make this a valuable resource for Millennial career and finance and Gen Z earning potential.

Investing in your financial education is one of the best decisions you can make. These books offer a solid foundation of knowledge and practical strategies to help Millennials and Gen Z navigate the complexities of personal finance and build a secure financial future. Start reading today and take control of your financial destiny!