What to check before opening an account with a brokerage firm

Learn what to avoid before creating an account with a brokerage firm

The digital revolution of the 2020s has fundamentally changed how we interact with the stock market. Today, opening a brokerage account is as simple as downloading an app and snapping a photo of your ID. However, this convenience often leads investors to skip the most critical step: due diligence.

In 2026, the landscape of retail investing is more crowded than ever. With hundreds of platforms competing for your capital—ranging from legacy giants to “gamified” mobile startups—making the wrong choice can lead to hidden fees, poor execution, or even the loss of your assets. This guide provides a comprehensive roadmap of everything you must verify before you hit that “Open Account” button.

Regulatory Compliance: Verifying SIPC and FINRA Membership

The first and most non-negotiable step is ensuring your money is actually protected by law. In the United States, a legitimate brokerage must be registered with two primary organizations.

Why You Must Use FINRA BrokerCheck

The Financial Industry Regulatory Authority (FINRA) is a government-authorized non-profit that oversees broker-dealers. Before you sign up, you should use the FINRA BrokerCheck tool. This database allows you to see the firm’s history, any past legal or regulatory violations, and whether their licenses are active. If a firm isn’t in this database, walk away immediately.

The Role of SIPC Protection

The Securities Investor Protection Corporation (SIPC) is your safety net. If your brokerage goes bankrupt, the SIPC works to restore your cash and securities.

-

Limit: Up to $500,000 per customer, including a $250,000 limit for cash.

-

Note: Always verify the “SIPC Member” logo on the brokerage’s homepage and double-check their membership on the official SIPC website.

Evaluating Brokerage Fees: Beyond Zero-Commission Trading

Since 2019, “zero-commission” has become the industry standard for stocks and ETFs. However, “free” is rarely truly free. Brokerages have found creative ways to generate revenue, and these costs can quietly erode your portfolio’s growth over time.

Hidden Costs to Look For

-

Payment for Order Flow (PFOF): Many free brokers make money by sending your orders to “market makers” instead of the public exchange. This can sometimes result in a slightly worse price for your stock.

-

Margin Rates: If you plan on borrowing money to trade (margin), check the interest rates. They vary wildly from 5% to over 13%.

-

Options Fees: While stocks might be free, many platforms still charge $0.50 to $0.65 per options contract.

-

Wire Transfer and ACATS Fees: Check how much it costs to move your money out. An “ACATS” fee (moving your stocks to a different broker) often costs between $75 and $100.

The Impact of Expense Ratios

If you are buying the brokerage’s own mutual funds or ETFs, check the expense ratio. Even a 0.5% difference in fees can cost you tens of thousands of dollars over a 30-year investing horizon.

| Fee Type | What is “Good”? | What is “Bad”? |

| Stock/ETF Commission | $0.00 | Anything above $0.00 |

| Options Contract | $0.00 – $0.50 | $1.00+ per contract |

| Inactivity Fee | None | Monthly fees for not trading |

| Paper Statement Fee | $0.00 (Go digital!) | $2.00 – $5.00 per month |

Investment Product Availability: Stocks, Bonds, and the Rise of Fractional Shares

Not all brokerages offer the same products. Before opening an account, you need to ensure the platform aligns with your specific investment strategy.

Fractional Shares: A Game Changer for Small Accounts

If you only have $100 to invest but want to own a piece of a company whose stock costs $3,000 per share, you need fractional shares. This allows you to buy $10 worth of any stock. Not all “legacy” brokers offer this, so if you are starting small, this feature is essential.

Diversification Options

A high-quality brokerage should offer more than just stocks. Look for:

-

ETFs (Exchange-Traded Funds): Low-cost ways to own the entire market.

-

Bonds and Treasuries: Especially important in a high-interest-rate environment.

-

International Markets: Can you buy stocks on the London or Tokyo exchanges, or are you limited to the US?

-

Cryptocurrency: Some modern brokers allow you to hold Bitcoin alongside your stocks, which simplifies tax reporting.

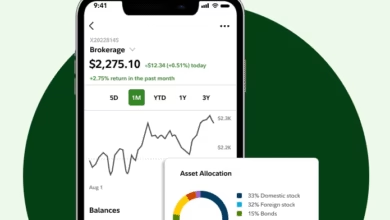

The Technical Edge: User Interface and Mobile App Performance

In 2026, your brokerage is essentially a piece of software. If that software is slow, buggy, or difficult to navigate, it could cost you money—especially during periods of high market volatility.

Desktop vs. Mobile

-

Active Traders: If you trade frequently, you need a robust desktop platform with advanced charting tools (like Thinkorswim or Fidelity Active Trader Pro).

-

Passive Investors: If you just buy and hold, a clean, simple mobile app is likely all you need.

Pro Tip: Download the app before you fund the account. Most brokerages allow you to browse the interface or use a “demo mode” (paper trading) to see if you like the layout.

Speed of Execution

When you click “Buy,” how fast does the order go through? This is called latency. While it doesn’t matter much for long-term investors, for day traders, a one-second delay can be the difference between a profit and a loss.

Security Protocols: Protecting Your Account from Modern Cyber Threats

Your brokerage account is a high-value target for hackers. A simple password is no longer enough. You must verify that the brokerage uses industry-leading security measures.

Advanced Multi-Factor Authentication (MFA)

Avoid brokers that only offer SMS (text message) authentication. SMS can be intercepted via “SIM swapping.” Instead, look for:

-

Authenticator Apps: Support for Google Authenticator or Authy.

-

Hardware Keys: Support for physical security keys like YubiKey.

-

Biometrics: FaceID or fingerprint scanning for mobile access.

Withdrawal Whitelisting and Alerts

The best brokerages offer “Whitelisting.” This means that even if a hacker gets into your account, they can only send money to a bank account you have already verified. Additionally, ensure the broker sends real-time push notifications for every trade and login.

Customer Support Reliability: Why Human Access Matters

When something goes wrong—like a missing wire transfer or a locked account—you do not want to be stuck talking to a chatbot.

How to Test Support

Before depositing money, try to contact their support team.

-

Do they have a phone number? Many “app-only” brokers have removed phone support entirely.

-

What is the wait time?

-

Are they knowledgeable? Ask a specific question about “cost basis reporting” or “wash sale rules” to see if the representative actually understands finance.

Educational Resources and Research Tools

A good brokerage shouldn’t just be a place to spend money; it should be a place to learn. The top-tier firms provide their clients with professional-grade research for free.

What to Look For:

-

Third-Party Reports: Access to Morningstar, Reuters, or CFRA research.

-

Stock Screeners: Tools that let you filter stocks by P/E ratio, dividend yield, or sector.

-

Tax Tools: Does the broker provide “Tax Loss Harvesting” tools or easy-to-read 1099 forms at the end of the year?

-

Educational Webinars: Especially for complex topics like options or fixed-income investing.

Account Types: Individual, Retirement, and Beyond

Before you sign up, you must know which type of account you need. Choosing the wrong one can result in massive tax penalties.

-

Taxable Brokerage Account: Standard account. You pay taxes on gains every year. No withdrawal restrictions.

-

Traditional IRA: Contributions may be tax-deductible, and growth is tax-deferred until retirement.

-

Roth IRA: You pay taxes now, but your withdrawals in retirement are 100% tax-free.

-

Joint Accounts: For couples who want to invest together.

-

Custodial Accounts (UTMA/UGMA): For parents investing for their children.

The “Fine Print” Check: Account Minimums and Transfers

Finally, check the “friction” involved in using the account.

Account Minimums

Many high-end brokerages used to require $2,500 or $10,000 just to open an account. Today, most have $0 minimums, but some specialized platforms (like those for hedge-fund-style strategies) still have high entry bars.

The Ease of Moving Money

Check if the broker supports Instant Deposits. Some apps allow you to trade with up to $1,000 immediately after you initiate a transfer, even before the money has cleared from your bank. This is incredibly helpful if you see a “dip” in the market you want to buy.

Don’t Rush the Decision

Choosing a brokerage is a long-term commitment. Your relationship with your investment platform might last longer than your car or even your home. By verifying the regulation, fee structure, security, and support, you ensure that your platform is a partner in your wealth creation rather than an obstacle.

In 2026, the best brokerage is the one that stays out of your way, keeps your costs low, and provides the security to let you sleep at night.