If you’re one of the more than 100 million Americans who rent your home, you’ve probably heard of renters insurance. Your landlord might even require you to have it. This often leads to a common, cynical question: “Is this just another junk fee, or is renters insurance worth it?”

Let’s be direct: In 2025, renters insurance is not just “worth it”; it is one of the single most important and cost-effective financial safety nets you can buy.

Many renters skip it, thinking they’re saving $20 a month. In reality, they are sitting on a financial time bomb, exposed to $50,000 in personal property loss or a $500,000 lawsuit from one simple accident.

The problem is a fundamental misunderstanding of who is responsible for what. This guide will break down exactly what renters insurance is, what it covers, what it doesn’t cover, and why the “it’s too expensive” argument is a myth that could cost you everything.

The Billion-Dollar Misconception: “My Landlord’s Insurance Covers Me”

This is the single most dangerous assumption a renter can make.

Your landlord 100% has an insurance policy. It’s called a “landlord policy” or “dwelling policy.” Here is all it covers:

- The physical building structure (the walls, roof, foundation)

- The landlord’s personal property (e.g., the appliances they own)

- The landlord’s own liability (if they are sued for negligence)

Now, here is what it does not cover:

- Your belongings (your TV, laptop, furniture, clothes)

- Your liability (if you are sued)

- Your hotel bills if you’re forced to move out during repairs

Think of it this way: Your landlord insures the box. You are responsible for everything you put inside the box, including your own financial responsibility.

If a fire (not caused by you) burns down the building, your landlord’s insurance will rebuild the building. You will get a check for $0 to replace your $30,000 in personal belongings. You will also have to pay for your own hotel.

What Does Renters Insurance Actually Cover? (The Big Three Explained)

A standard renters policy (often called an HO-4 policy) is a package of three distinct coverages. Understanding them is key to seeing the value.

1. Personal Property Protection (Coverage C)

This is the part everyone thinks of. It protects your “stuff.” If your belongings are stolen, damaged, or destroyed by a covered event (a “peril”), the policy pays to repair or replace them, up to your coverage limit.

Common “covered perils” include:

- Fire and smoke

- Theft (both inside and outside your home, like your laptop stolen from your car)

- Vandalism

- Windstorm and hail

- Water damage from internal sources (like a burst pipe or overflowing tub)

- Falling objects

This covers everything you own: your $2,000 laptop, your $1,500 sofa, your $5,000 wardrobe, your kitchen supplies, your kids’ toys. Most people dramatically underestimate the value of their belongings.

2. Personal Liability (Coverage E)

This is the most important part of your policy, and it’s the one most people ignore.

Personal liability is your financial shield against the world. It protects you if you or a member of your household accidentally injures someone or damages their property. It pays for their medical bills, their property repair, and—most critically—your legal defense fees up to your policy limit.

Standard limits start at $100,000, but in 2025, that is dangerously low. We recommend a minimum of $300,000 or $500,000.

Real-World Scenarios Where Liability Saves You:

- The Overflowing Tub: You leave the bathtub running, and it floods your apartment and leaks into the unit below, destroying your neighbor’s $10,000 entertainment system and their ceiling. Your liability coverage pays for those damages.

- The Dog Bite: Your (normally friendly) dog nips a visitor or a child at the park. The average dog bite claim costs over $50,000. Your liability coverage pays the medical bills and any legal settlement.

- The Tripping Friend: A guest comes over, trips on your rug, and breaks their wrist. They sue you for $75,000 in medical bills and lost wages. Your policy covers the lawsuit and the payout.

Without this coverage, your wages could be garnished, and your savings (and future 401(k) contributions) could be wiped out.

3. Additional Living Expenses (ALE) (Coverage D)

This is the “lifesaver” coverage. If a covered peril (like a fire or major pipe burst) makes your apartment unlivable, your ALE coverage pays for the increase in your living expenses while it’s being repaired.

This includes:

- Hotel bills

- The cost of restaurant meals (above your normal grocery budget)

- Laundry services

- Pet boarding fees

This coverage prevents one disaster from turning into a second one. You can focus on getting your life back together instead of worrying about how to pay for a $200/night hotel for three weeks.

Actual Cash Value (ACV) vs. Replacement Cost (RCV): The One Detail You Can’t Ignore

This is arguably the most critical choice you will make when buying a policy. It directly impacts your payout after a claim and is a huge factor in whether the insurance is “worth it.”

- Actual Cash Value (ACV): This is the default, cheaper option. ACV pays you what your item was worth at the moment it was destroyed. It’s the purchase price minus depreciation.

- Example: You bought a sofa for $2,000 five years ago. It’s old and has some stains. Its “actual cash value” today might only be $300. After your $250 deductible, you get a check for $50. You cannot buy a new sofa for $50.

- Replacement Cost (RCV): This is the option you want. RCV pays the full cost to buy a brand new item of similar kind and quality at today’s prices.

- Example: Your 5-year-old, $2,000 sofa is destroyed. A comparable new sofa today costs $2,200. After your deductible, the policy pays out the full $2,200. You can actually go buy a new sofa.

An RCV policy might cost 10-20% more per month, but it is the only way to truly be made whole after a total loss. An ACV policy will always leave you disappointed and underfunded.

How Much Renters Insurance Do I Actually Need in 2025?

Don’t just guess. “I’ll take $20,000 in coverage” is a common mistake.

Calculating Your Property Coverage (The Home Inventory)

The only way to know is to do a quick home inventory. You will be shocked at what you own. Go room by room with your smartphone’s video camera.

- Living Room: TV, soundbar, sofa, chairs, rug, coffee table, lamps, bookshelves, books…

- Kitchen: Small appliances (mixer, air fryer), pots & pans, all your dishes, glasses, silverware…

- Bedroom: Mattress, bed frame, dressers, nightstands…

- Closet: This is the big one. 20 shirts, 10 pairs of pants, 5 pairs of shoes, jackets, suits… Your wardrobe alone could be worth $5,000 – $10,000.

The average renter has between $30,000 and $50,000 in personal property. Your $20,000 guess is likely not enough.

Choosing Your Liability Limit (The “Million-Dollar” Question)

As mentioned, the standard $100,000 limit is no longer sufficient in 2025. A single slip-and-fall lawsuit can easily exceed this.

- Recommended Minimum: $300,000

- Smart Choice: $500,000

The best part? The cost to upgrade from $100,000 to $500,000 in liability is usually less than $20 per year. It is the cheapest and best financial protection you can buy.

The Real Cost: How Much is Renters Insurance in 2025?

We’ve established the value, but is it affordable? The U.S. national average for renters insurance is between $15 and $20 per month ($180 – $240 per year) for a standard policy with Replacement Cost (RCV) coverage.

That’s it.

For the price of one streaming service or two cups of coffee per month, you are protecting yourself from a $30,000 property loss and a $500,000 lawsuit.

When you reframe the cost, the “is it worth it” question answers itself.

- Cost of a large pizza: $20

- Cost of a lawsuit: $50,000+

- Cost of renters insurance: $18

5 Common Myths About Renters Insurance, Debunked

- “I Don’t Own Enough to Insure.” You do. As the home inventory exercise shows, the cost of replacing your entire wardrobe, all your furniture, and all your electronics at today’s prices is staggering.

- “It’s Too Expensive.” As shown above, it’s not. In fact, if you follow our bundling tip (see below), it can be virtually free.

- “My Roommate’s Policy Covers Me.” It absolutely does not. A renters policy covers the person named on the policy and their resident relatives (spouse, children). It does not cover your roommate. If you live with roommates, you each need your own policy.

- “My Landlord Requires It, So It Must Be a Scam.” Your landlord requires it because you are a liability risk to them. If you overflow the tub and damage the building, their insurer will fix the building and then sue you for the $20,000 in damages. Your liability policy pays for this. Your landlord is protecting their asset from you, and in doing so, is forcing you to protect yourself.

- “I’m Careful, So a Disaster Won’t Happen.” You may be careful, but your neighbor upstairs who leaves a candle burning may not be. You can’t control a regional windstorm, a burst pipe in the wall, or a thief who breaks in while you’re at work.

What Renters Insurance Does Not Cover (Critical Exclusions)

To be a smart consumer, you also need to know the limitations. A standard renters policy does NOT cover:

- Floods: This is the #1 exclusion. Water damage from a burst pipe inside is covered. Water from groundwater rising (a river overflowing, hurricane surge) is NOT. You need a separate policy from the National Flood Insurance Program (NFIP).

- Earthquakes: This is also excluded and requires a separate policy or an “endorsement” (an add-on).

- High-Value Items: Your policy has “sub-limits” on certain categories. For example, it might only cover $1,500 for all your jewelry, or $2,500 for electronics. If you have a $10,000 engagement ring or a $5,000 camera collection, you need a “rider” or “floater” to insure that item specifically.

- Pests (Bed Bugs, Mice): The cost of mitigating a pest infestation is considered a maintenance issue, not a “sudden and accidental” peril.

- Your Car: Your auto insurance policy covers your car.

How to Get the Best Deal on Renters Insurance (Actionable Tips)

You’re convinced. Now, how do you get the best possible price?

1. The Power of Bundling (This is the #1 Tip)

If you have car insurance, call that company first. The “multi-policy discount” they give you on both your auto and renters policies is often so large that the renters policy becomes nearly free.

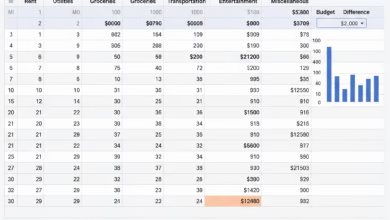

Example:

- Your auto insurance: $1,200/year

- A new renters policy: $180/year

- Your 15% multi-policy discount on auto: -$180

- Total Cost for Both: $1,200. Your renters insurance is effectively free.

2. Shop Around (The 15-Minute Rule)

Always get at least three quotes.

- Call your auto insurer.

- Get a quote from a traditional carrier (like State Farm or Allstate).

- Get an online quote from a modern insurer (like Lemonade or Toggle).

3. Ask About Discounts

Insurers are loaded with discounts, but they don’t always apply them automatically. Ask for:

- Safety Discounts: Do you have a smoke detector, fire extinguisher, or burglar alarm?

- Claims-Free Discount: Have you gone 5+ years without a claim?

- Loyalty Discount: Have you been with the company for several years?

4. Adjust Your Deductible

Your deductible is the amount you pay out-of-pocket on a property claim before insurance pays.

- A low deductible ($250) = a higher monthly premium.

- A high deductible ($1,000) = a lower monthly premium.

We recommend a deductible you can easily cover from your emergency fund. For most people, $500 or $1,000 is the sweet spot that provides the best balance of premium savings and protection.

Is Renters Insurance a Necessity or a “Nice to Have”?

In 2025, with rising replacement costs due to inflation, increasing liability risks, and more frequent weather events, renters insurance has moved firmly into the necessity category.

It is a high-leverage financial tool. You pay a tiny, predictable amount (about $18/month) to protect yourself from a catastrophic, unpredictable loss (a $300,000 lawsuit or a $50,000 fire).

Skipping it to “save” $200 a year is like driving a car without liability insurance to “save” money. It’s not saving; it’s just taking on a massive, unmanaged risk.

Don’t wait until you see smoke or hear a dripping sound from the apartment above. Take 15 minutes today, bundle it with your auto policy, and give yourself true financial peace of mind.