10 Questions to Ask Before Signing a Policy

Take a look at these questions to ask yourself before purchasing insurance.

In a world of unforeseen circumstances, a robust insurance policy stands as a formidable shield, protecting your financial well-being against the unexpected. Whether it’s your home, your car, your health, or your life, the right coverage can provide invaluable peace of mind. However, the world of insurance can be a labyrinth of complex jargon and fine print, often leaving consumers feeling overwhelmed and uncertain. Signing a policy without fully understanding its intricacies can lead to costly surprises down the road.

This comprehensive guide is designed to empower you with the knowledge to navigate the insurance landscape like a seasoned pro. We will delve into ten critical questions you must ask before committing to any policy. By seeking clarity on these key points, you can ensure the coverage you choose is not only competitively priced but also perfectly aligned with your unique needs and circumstances. We will also explore advanced strategies for interpreting policy documents, comparing quotes effectively, and understanding the vital role of deductibles and policy limits.

What Are the Full Scope and Limitations of This Coverage?

One of the most fundamental yet overlooked aspects of an insurance policy is understanding precisely what is covered and, just as importantly, what is not. Don’t be swayed by a policy’s attractive premium without first dissecting its scope. Ask for a detailed breakdown of covered events, also known as “perils.” For instance, a standard homeowner’s policy might cover fire and theft, but does it include flood or earthquake damage? These are often excluded and require separate policies or endorsements.

Similarly, when examining a health insurance plan, inquire about the specifics of coverage for prescription drugs, specialist visits, and mental health services. Are there limitations on the number of physical therapy sessions or chiropractic adjustments you can receive annually? For auto insurance, clarify if the policy includes coverage for rental car reimbursement or towing and labor costs.

Delving into the “Exclusions” and “Limitations” sections of the policy document is non-negotiable. This is where you’ll find the fine print that outlines scenarios where the insurer will not pay. Proactively asking for a clear explanation of these sections can prevent major headaches and financial strain when you need to file a claim.

Can You Explain the Declarations Page in Simple Terms?

The Declarations Page is typically the first page of your insurance policy, and it serves as a concise summary of your coverage. Think of it as the policy’s “cheat sheet.” However, it can still contain terminology that may be unfamiliar to the average person. Before proceeding, ask your agent or a company representative to walk you through this page line by line.

Key items on the Declarations Page to scrutinize include:

- Policy Number and Period: This identifies your unique policy and the dates your coverage is active.

- Named Insured: Ensure your name and the names of any other covered individuals (like a spouse or family members) are spelled correctly.

- Property or Vehicle Information: For home or auto insurance, verify that the address or vehicle details (make, model, VIN) are accurate.

- Coverage Types and Limits: This is a crucial section that lists the different types of coverage you have and the maximum amount the insurance company will pay for each. We will explore policy limits in more detail later.

- Deductibles: This indicates the amount you are responsible for paying out-of-pocket before the insurance coverage kicks in for each claim.

- Premiums: This shows the cost of your insurance policy, which can be broken down into monthly, quarterly, or annual payments.

- Endorsements and Riders: This section lists any add-ons or modifications to the standard policy.

A thorough understanding of the Declarations Page provides a vital snapshot of your protection and is your first line of defense against misunderstandings.

How Will My Premium and Deductible Impact My Out-of-Pocket Costs?

The relationship between your premium and your deductible is a critical factor in the overall cost of your insurance. In simple terms:

- Premium: This is the fixed amount you pay regularly (monthly, semi-annually, or annually) to keep your policy active.

- Deductible: This is the amount you must pay out of your own pocket for a covered loss before your insurance company starts to pay.

Generally, a higher deductible will result in a lower premium, and conversely, a lower deductible will lead to a higher premium. It’s a balancing act. When considering your options, ask for quotes with different deductible amounts. This will allow you to see the direct impact on your premium.

The key is to choose a deductible that you can comfortably afford to pay at a moment’s notice. A low premium might seem appealing, but if it’s attached to a $5,000 deductible that you don’t have readily available, the policy may not provide the immediate financial relief you need in a crisis. A detailed conversation about your budget and risk tolerance with an insurance professional can help you find the sweet spot between an affordable premium and a manageable deductible.

What Are the Policy Limits, and Are They Sufficient for My Needs?

A policy limit is the maximum amount an insurance company will pay for a covered claim. Understanding these limits is paramount, as they directly determine the extent of your financial protection. Exceeding your policy limits can leave you personally responsible for the remaining costs, which could be substantial.

Policy limits can be structured in a few different ways:

- Per-Occurrence Limit: The maximum amount paid for a single event or claim.

- Per-Person Limit: In liability coverage, this is the maximum amount paid for injuries to a single person.

- Aggregate Limit: The total maximum amount the insurer will pay for all claims during a policy period.

When discussing policy limits, ask your agent to help you assess your individual needs. For homeowners insurance, the dwelling coverage limit should be high enough to completely rebuild your home in the event of a total loss, factoring in current construction costs in your area. For auto insurance, consider your assets when selecting liability limits. If you cause an accident with significant injuries and property damage, you want to ensure your limits are high enough to protect your savings and other assets from a potential lawsuit. Don’t be afraid to ask for higher limit options and the corresponding premium increases; the additional peace of mind is often well worth the modest cost.

Are There Any Optional Coverages or Endorsements I Should Consider?

Standard insurance policies provide a solid foundation of protection, but they may not cover all of your specific needs. This is where endorsements and riders come into play. These are optional add-ons that can enhance or broaden your coverage.

Before signing, inquire about available endorsements that might be relevant to your situation. For example:

- Homeowners Insurance: You might consider endorsements for scheduled personal property (for high-value items like jewelry or art), water backup and sump pump overflow, or ordinance or law coverage (to cover the costs of rebuilding to current building codes after a loss).

- Auto Insurance: Popular endorsements include roadside assistance, new car replacement coverage, and gap insurance (which covers the difference between the actual cash value of your car and the amount you still owe on your loan if it’s totaled).

- Life Insurance: Riders can add benefits like an accelerated death benefit (which allows you to access a portion of your death benefit if you’re terminally ill) or a waiver of premium (which covers your premiums if you become disabled and can’t work).

A good insurance professional will take the time to understand your lifestyle and assets to recommend endorsements that provide a more customized and comprehensive safety net.

What Discounts Are Available to Help Lower My Premium?

Insurance companies offer a wide array of discounts, and you could be leaving significant savings on the table if you don’t ask about them. These discounts are designed to reward policyholders for being lower-risk customers.

Be proactive and inquire about all possible discounts, which may include:

- Multi-Policy Discount: Bundling your auto and home insurance with the same company is one of the most common and substantial discounts.

- Good Student Discount: For young drivers on your auto policy who maintain a certain GPA.

- Safe Driver Discount: Awarded for having a clean driving record with no accidents or violations.

- Safety and Security Discounts: For homeowners, this can include discounts for having smoke detectors, fire extinguishers, a burglar alarm, or deadbolt locks. For auto insurance, features like anti-lock brakes and airbags can lead to savings.

- Loyalty Discount: Some insurers reward long-term customers with reduced premiums.

- Paid-in-Full Discount: You may receive a discount for paying your annual premium in one lump sum rather than in installments.

Never assume that all eligible discounts have been automatically applied to your quote. A quick conversation can often lead to a more affordable policy without sacrificing coverage.

Can You Walk Me Through the Step-by-Step Process of Filing a Claim?

When you’re in the midst of a stressful situation that requires you to file an insurance claim, the last thing you want is confusion about the process. Before you sign a policy, ask for a clear explanation of how to file a claim.

Key questions to ask about the claims process include:

- Who is my first point of contact? Should you call a local agent or a national claims hotline?

- What information will I need to provide? This may include your policy number, a description of the incident, and any relevant documentation like police reports or photos.

- What are the timeframes I need to be aware of? There are often deadlines for reporting a claim and submitting documentation.

- How will the damages be assessed? Will the company send an adjuster? Can I use my own contractor for repairs?

- How long does the claims process typically take from start to finish?

A transparent and efficient claims process is a hallmark of a reputable insurance company. Understanding the procedure beforehand can make a difficult experience much more manageable.

How Can I Effectively Compare This Quote with Others?

Getting multiple insurance quotes is a smart financial move, but a true “apples-to-apples” comparison requires more than just looking at the price. To compare quotes effectively, you need to ensure you’re evaluating policies with identical or very similar coverage levels.

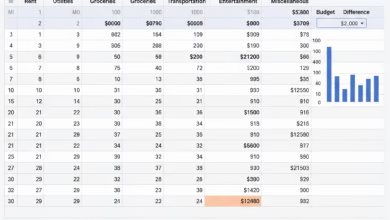

When you have multiple quotes in hand, create a simple spreadsheet to compare the following for each policy:

- Coverage Types: Make sure each quote includes the same types of coverage (e.g., liability, collision, comprehensive for auto insurance).

- Policy Limits: The limits for each coverage should be the same across all quotes you’re comparing.

- Deductibles: Ensure the deductible for each coverage is consistent.

- Endorsements: If you’ve requested specific add-ons, verify that they are included in each quote.

Once you have a true side-by-side comparison, you can then factor in the premium. Don’t be tempted by a significantly lower price if it means sacrificing crucial coverage. A detailed comparison will reveal the true value of each offer.

What Is the Role of an Insurance Broker, and Should I Consider Using One?

Navigating the insurance market can be complex, and this is where an insurance broker can be an invaluable ally. Unlike an insurance agent who typically represents a single company, an independent insurance broker works for you. They have access to policies from a wide range of insurers and can help you find the best coverage at the most competitive price.

The benefits of using a broker include:

- Expertise and Unbiased Advice: Brokers have in-depth knowledge of the insurance industry and can offer impartial advice tailored to your needs.

- Time Savings: A broker does the shopping for you, saving you the time and effort of contacting multiple companies for quotes.

- Advocacy: If you need to file a claim, your broker can act as your advocate, helping you navigate the process and ensuring you receive a fair settlement.

While you can certainly purchase insurance directly from a company, consulting with a broker can provide an extra layer of expertise and personalized service, often at no additional cost to you, as they are typically compensated by the insurance company they place your policy with.

What Is the Insurer’s Reputation for Customer Service and Financial Stability?

The promises made in an insurance policy are only as good as the company that stands behind them. Before you sign, it’s essential to research the insurer’s reputation. Look for information on their customer service, particularly their claims handling process. Online reviews and consumer reports can provide valuable insights into the experiences of other policyholders.

Equally important is the company’s financial stability. You want to be sure that your insurer has the financial strength to pay out claims, even in the event of a large-scale disaster. Independent rating agencies like A.M. Best, Moody’s, and Standard & Poor’s evaluate the financial health of insurance companies. Look for companies with high ratings, as this indicates a strong ability to meet their financial obligations to policyholders.

Asking about an insurer’s reputation and financial ratings is a crucial final step in your due diligence. It ensures that you’re not just buying a policy, but a promise of protection from a reliable and trustworthy partner.

By arming yourself with these ten essential questions, you can approach the process of buying insurance with confidence and clarity. Taking the time to thoroughly understand your policy before you sign is an investment that will pay dividends in the form of security and peace of mind for years to come.