Top Books for Understanding Financial Crises and Market Bubbles

Discover the Best Books to Understand Financial Market Crises

Understanding financial crises and the dramatic rise and fall of market bubbles can feel like trying to decipher an ancient language. However, by exploring the insights of those who have witnessed or deeply studied these events, we can gain invaluable knowledge to navigate the complex world of finance. This article highlights some of the best books on financial crises, offering accessible explanations for everyone, from seasoned investors to those just starting their financial journey. Learning about market bubble history is crucial for making informed decisions and potentially safeguarding your financial future.

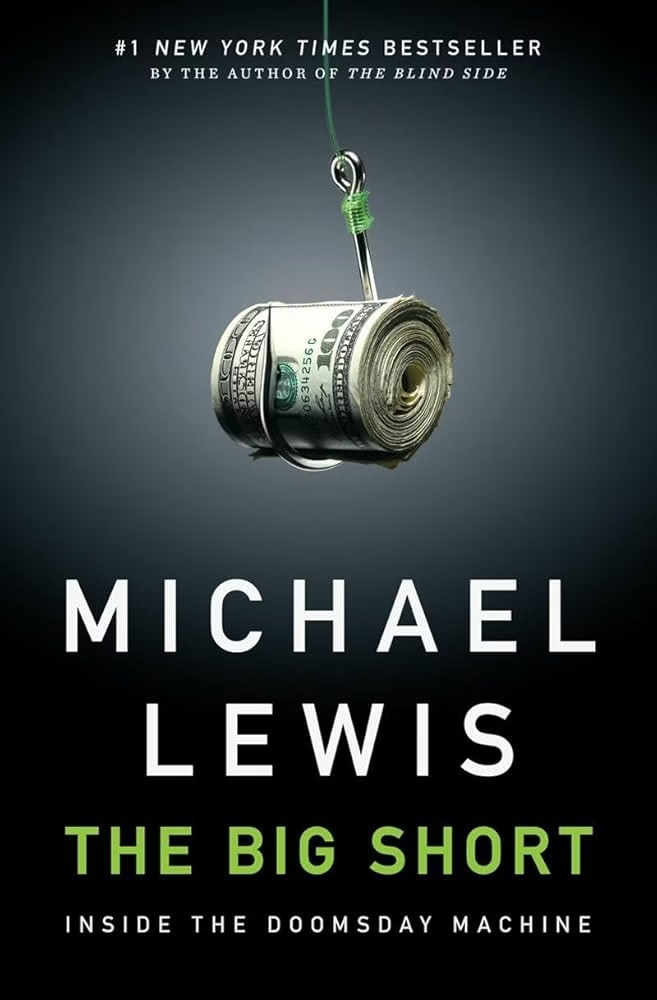

The Big Short: Inside the Doomsday Machine – A Front-Row Seat to the 2008 Crisis

Michael Lewis’s gripping narrative, The Big Short, provides a captivating and often infuriating look at the lead-up to the 2008 financial crisis. Through the stories of a few unconventional investors who saw the housing bubble for what it was, Lewis demystifies complex financial instruments like mortgage-backed securities and CDOs. This book is highly engaging and explains the causes of the 2008 financial crisis in a way that’s both informative and entertaining, making it a fantastic entry point for understanding how financial bubbles burst. It’s a must-read for anyone wanting to grasp the human element behind major economic collapses.

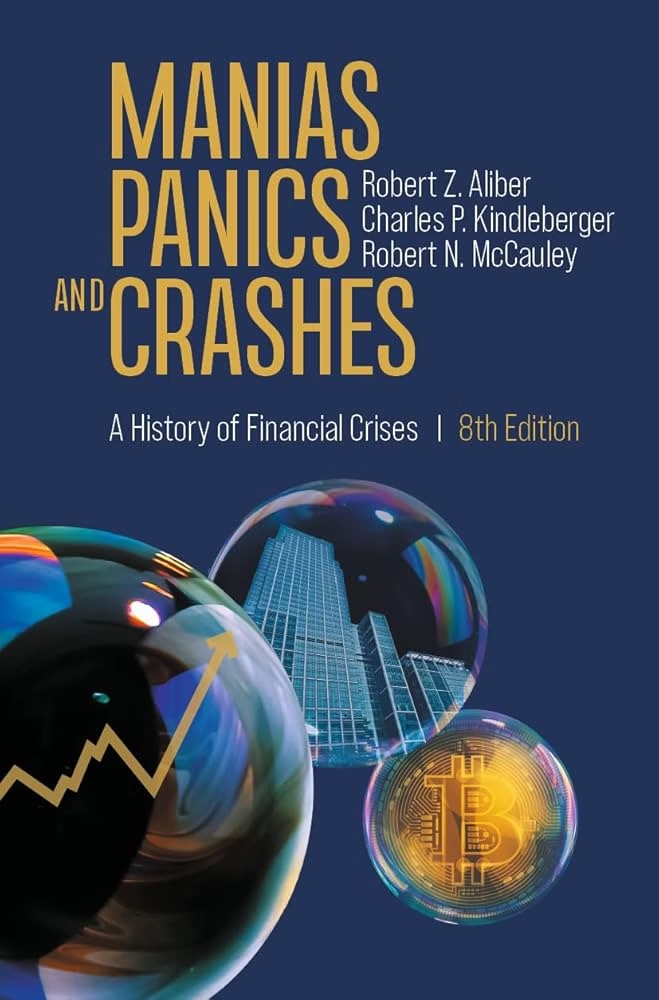

Manias, Panics, and Crashes: A History of Financial Crises – Timeless Lessons from the Past

Charles P. Kindleberger and Robert Z. Aliber’s classic work, Manias, Panics, and Crashes, offers a comprehensive historical overview of financial crises spanning centuries. By examining various episodes of speculative bubbles and subsequent crashes, the authors identify recurring patterns and psychological factors that drive these events. Understanding these historical parallels is key to recognizing potential signs of a market bubble today. This book provides a broader context for understanding the cyclical nature of financial markets and the importance of learning from historical financial disasters.

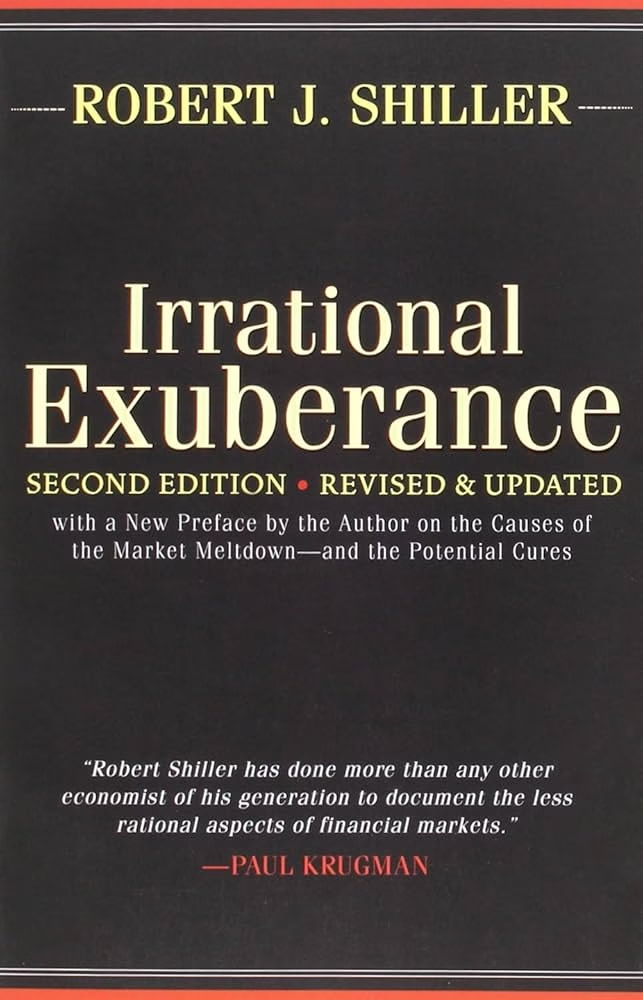

Irrational Exuberance – Understanding Speculative Bubbles and How to Prevent Them

In Irrational Exuberance, Nobel laureate Robert J. Shiller delves into the psychological and social factors that fuel asset bubbles, particularly in the stock market and real estate. Shiller’s analysis highlights how investor psychology and herd behavior can lead to overvaluation and eventual market corrections. This book offers valuable insights into the psychology of market bubbles and provides a framework for identifying and potentially avoiding the pitfalls of speculative investment. It’s essential reading for anyone wanting to understand the behavioral economics of financial crises.

This Time Is Different: Eight Centuries of Financial Folly – Why History Often Repeats Itself

Carmen M. Reinhart and Kenneth S. Rogoff’s This Time Is Different is a sobering reminder that despite technological advancements and perceived sophistication, financial crises are a recurring feature of economic history. Through meticulous historical data analysis across eight centuries and numerous countries, the authors demonstrate the striking similarities in the patterns and consequences of financial crises, particularly those involving debt. This book powerfully illustrates why the mantra “this time is different” is often a dangerous delusion in the world of finance and why understanding long-term financial crisis trends is crucial.

Why These Books Matter for Your Financial Literacy

Understanding financial crises and market bubbles isn’t just for economists or Wall Street professionals. It’s crucial knowledge for anyone looking to build and protect their wealth. These books offer valuable lessons on:

- Identifying potential risks in the market.

- Understanding the psychological factors that drive investment decisions (and mistakes).

- Learning from past mistakes to avoid repeating them.

- Developing a more informed and resilient financial strategy.

By investing your time in reading these insightful books, you can empower yourself with the knowledge to navigate the complexities of the financial world and make more informed decisions, ultimately contributing to your long-term financial well-being. This understanding can also help you interpret financial news and analysis with a more critical and informed perspective.