3 psychology books to improve your finances

Take a look at these psychology books to improve your financial life

Ever wonder why you make certain financial decisions, even when you know better? The truth is, our relationship with money is deeply intertwined with our psychology. Understanding the underlying biases and behaviors that influence our spending, saving, and investing habits can be the key to achieving greater financial well-being. In this article, we’ll explore three insightful psychology books that offer valuable lessons for improving your finances and building a healthier money mindset.

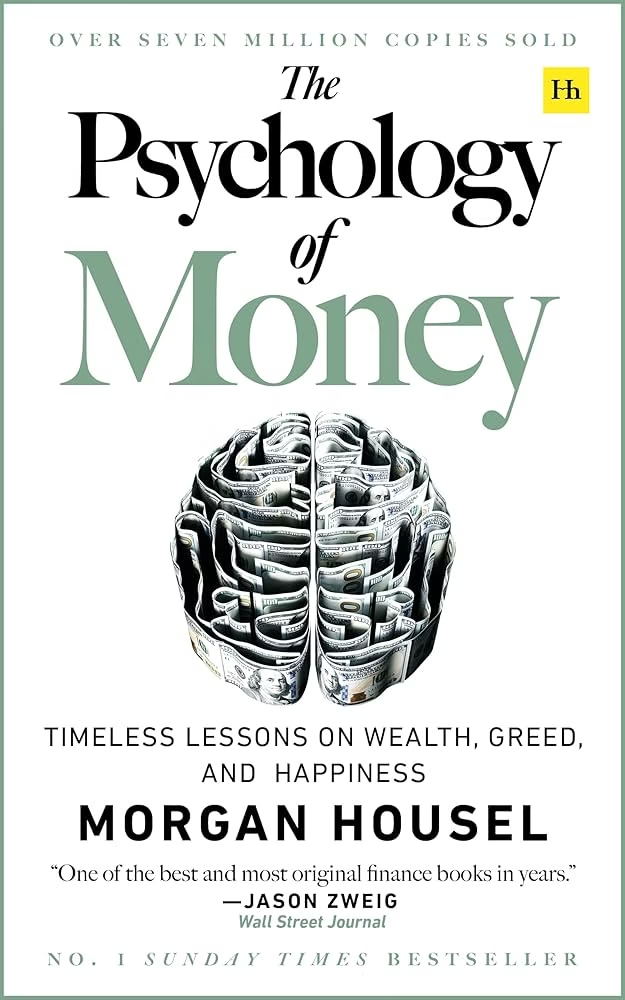

Decoding Your Money Mindset: “The Psychology of Money” for Financial Clarity

Morgan Housel’s “The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness” isn’t your typical finance book filled with complex formulas and investment strategies. Instead, it delves into the often irrational and emotional ways we think about money. This book is a must-read for anyone looking to understand the human side of financial success.

- Key Takeaways: Housel explores how our personal histories, experiences, and beliefs shape our financial decisions. He emphasizes that success with money isn’t necessarily about what you know, but how you behave. The book highlights the importance of a long-term perspective, the power of compounding, and the understanding that “enough” is a crucial concept.

- Why It’s Relevant to Your Finances: By understanding the psychological biases that can lead to poor financial choices (like overconfidence, fear of missing out, and the desire for instant gratification), you can become more aware of your own tendencies and make more rational decisions about saving, spending, and investing.

- Actionable Insights: “The Psychology of Money” encourages readers to focus on long-term wealth building over short-term gains, to understand the role of luck in financial outcomes, and to define their own definition of financial happiness.

Breaking Free from Bad Habits: “Atomic Habits” for Building Better Financial Routines

While James Clear’s “Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones” isn’t specifically about finance, its principles are incredibly applicable to improving your money management skills. Building positive financial habits is essential for long-term success, and this book provides a practical framework for achieving just that.

- Key Takeaways: Clear introduces the “Four Laws of Behavior Change” – Make it Obvious, Make it Attractive, Make it Easy, and Make it Satisfying. He argues that significant improvements come from small, incremental changes in your daily routines.

- Why It’s Relevant to Your Finances: Whether you’re struggling to save consistently, stick to a budget, or avoid impulsive spending, “Atomic Habits” offers actionable strategies for building better financial habits.

- Actionable Insights: Learn how to make saving automatic, track your spending effectively, make budgeting less painful, and reward yourself for positive financial behaviors. By applying the principles of “Atomic Habits,” you can create sustainable routines that lead to improved financial outcomes.

Overcoming Emotional Spending: “Your Money or Your Life” for a Values-Based Approach to Finance

Vicki Robin and Joe Dominguez’s “Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence” takes a holistic approach to personal finance, emphasizing the connection between your money and your life energy. This book encourages introspection and helps you align your spending with your values and goals.

- Key Takeaways: The book guides readers through a nine-step program that includes understanding how much you’ve earned in your lifetime, tracking your expenses meticulously, and identifying the “financial independence” point where your investment income can cover your living expenses. A key focus is on understanding the “life energy” exchanged for money and evaluating whether your spending aligns with what truly brings you fulfillment.

- Why It’s Relevant to Your Finances: “Your Money or Your Life” helps you become more mindful of your spending habits and question whether your purchases are truly adding value to your life. By connecting your money to your values, you can make more conscious decisions about where your hard-earned money goes.

- Actionable Insights: Learn how to calculate your financial independence number, minimize unnecessary expenses by evaluating the “life energy” cost of your purchases, and invest strategically to build passive income streams. This book encourages a fundamental shift in your perspective on money and its role in your overall well-being.

Reiterate the value of these books and encourage readers

Understanding the psychology behind our financial decisions is a powerful tool for improving our money habits and achieving our financial goals. These three books offer valuable insights and practical strategies for decoding your money mindset, building better financial routines, and aligning your spending with your values. Consider adding them to your reading list and embarking on a journey towards greater financial awareness and success!