Saving money can seem daunting, but with the right knowledge and tools, it’s entirely achievable. Whether you’re looking to build an emergency fund, save for a down payment on a home, or retire early, the books on this list can provide valuable insights and practical tips.

Why Read Books About Saving Money?

- Learn new habits: Discover effective strategies to reduce spending and increase savings.

- Gain financial knowledge: Understand the basics of budgeting, investing, and financial planning.

- Develop a savings mindset: Cultivate a mindset that prioritizes saving and financial security.

Must-Read Books for Saving Money

1. The Total Money Makeover by Dave Ramsey

Dave Ramsey’s no-nonsense approach to personal finance has helped millions of people get out of debt and build wealth. In this book, he outlines a seven-step plan for achieving financial freedom.

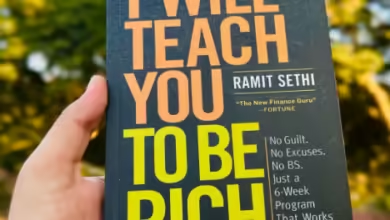

2. I Will Teach You to Be Rich by Ramit Sethi

Ramit Sethi offers a practical and actionable guide to personal finance. He provides clear and easy-to-follow steps for creating a budget, negotiating bills, and investing.

3. The Richest Man in Babylon by George S. Clason

This classic book, written in the form of parables, offers timeless advice on wealth building. It emphasizes the importance of saving, investing, and living below your means.

4. Your Money or Your Life by Vicki Robin

This book goes beyond traditional budgeting advice, encouraging readers to examine their relationship with money and make choices that align with their values.

5. The Barefoot Investor by Scott Pape

Scott Pape, also known as The Barefoot Investor, provides a straightforward guide to personal finance for Australians. While some of the specific advice may be tailored to the Australian market, his overall principles can be applied by anyone.

Additional Tips for Saving More Money

- Track your spending: Use a budgeting app or spreadsheet to monitor your expenses.

- Automate your savings: Set up automatic transfers from your checking to your savings account.

- Cut unnecessary expenses: Identify areas where you can reduce spending.

- Increase your income: Explore ways to earn extra money, such as a side hustle or selling unused items.

Reading these books can provide you with the knowledge and motivation you need to save more money and achieve your financial goals. Remember, small changes in your daily habits can lead to big results over time.