Investments

Find out how to invest in shares for your child

Complete informative guide helping you Buy Shares to set up an Investment portfolio for your child

Investing in the stock market can be a great way to secure your child’s financial future. By starting early, you can take advantage of compound interest and help your child build a nest egg for college, a home, or retirement. This guide will walk you through the steps of buying stocks for your child.

Understanding Custodial Accounts

- What is a custodial account? A custodial account is a brokerage account opened by an adult on behalf of a minor. The adult, known as the custodian, manages the account and makes investment decisions until the minor reaches a specified age.

- Why use a custodial account? Custodial accounts are specifically designed for minors and offer tax advantages.

- Types of custodial accounts:

- UTMA (Uniform Transfer to Minors Act)

- UGMA (Uniform Gift to Minors Act)

Choosing a Brokerage Firm

- Factors to consider:

- Fees

- Investment options

- Educational resources

- Customer service

- Popular options:

- Fidelity

- Vanguard

- Charles Schwab

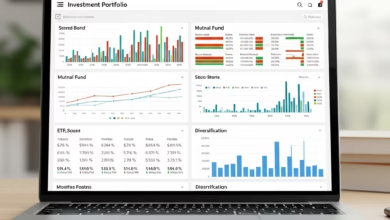

Choosing the Right Investments

- Index funds: A simple and cost-effective way to invest in the overall stock market.

- Dividend-paying stocks: Companies that pay out a portion of their profits to shareholders.

- ETFs: Exchange-traded funds offer a diversified way to invest in a specific sector or market.

- Target-date funds: Automatically adjust the asset allocation over time to become more conservative as the target date approaches.

Tips for Successful Investing

- Start small: Even small contributions can add up over time.

- Diversify: Spread your investments across different asset classes to reduce risk.

- Stay the course: Avoid making impulsive decisions based on short-term market fluctuations.

- Educate your child: Teach your child about money and investing as they grow older.

Tax Implications

- Kiddie tax: Understand how taxes are applied to unearned income in custodial accounts.

- Consult a tax advisor: For personalized advice on tax implications.

Conclusion

Investing for your child’s future is a gift that keeps on giving. By following these guidelines and choosing the right investments, you can help your child achieve their financial goals. Remember, investing involves risk, and past performance is not indicative of future results. It’s essential to do your research or consult with a financial advisor before making any investment decisions.