Discover the biographies of the greatest investors (Warren Buffett, Peter Lynch, etc.)

Discover the best biographies of legendary investors

Want to understand the secrets behind building incredible wealth and navigating the complex world of finance? There’s no better way than delving into the lives and strategies of those who have mastered the game. This article explores some of the most insightful biographies of legendary investors like Warren Buffett and Peter Lynch, offering invaluable lessons for both novice and seasoned individuals.

Warren Buffett Biography: Decoding the “Oracle of Omaha”

Warren Buffett, often dubbed the “Oracle of Omaha,” stands as a beacon of long-term, value-based investing. Understanding his journey can provide profound insights into disciplined investing and business acumen.

Key Takeaways from Buffett’s Life:

- The Power of Compounding: Buffett’s life story vividly illustrates the magic of compounding returns over decades.

- Value Investing Principles: Learn how Buffett identifies undervalued companies with strong fundamentals.

- Patience and Long-Term Vision: Discover the importance of holding investments through market fluctuations.

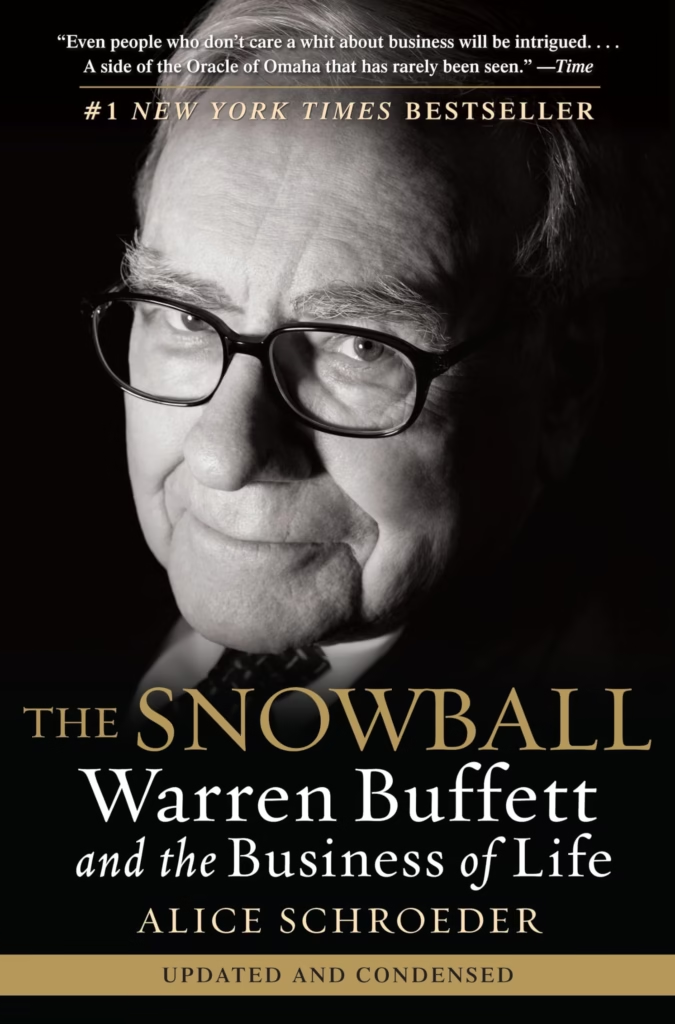

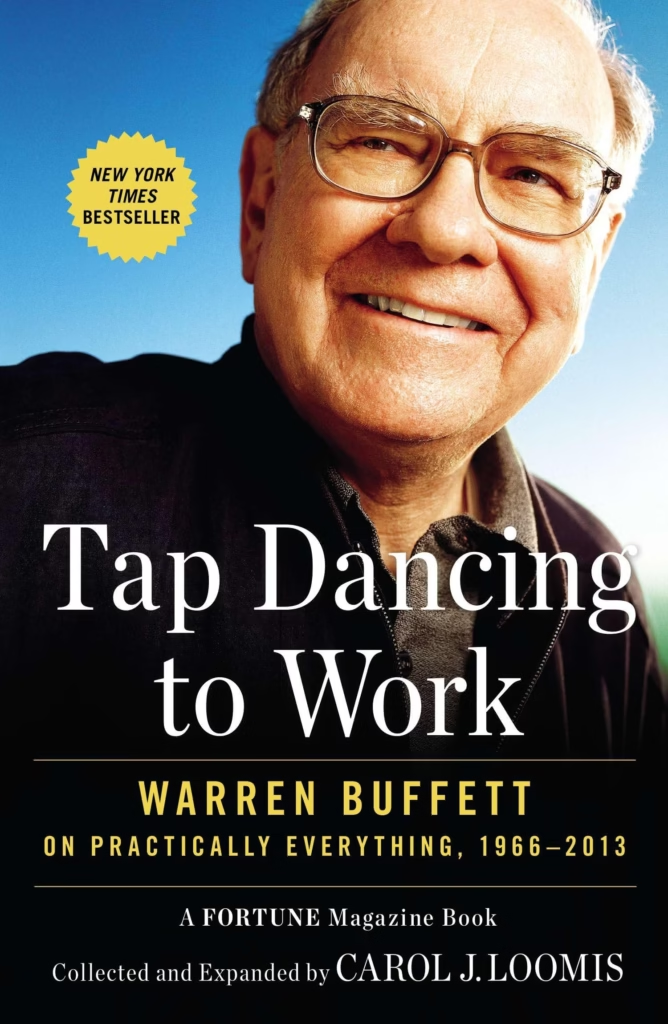

Must-Read Biographies of Warren Buffett:

- “The Snowball: Warren Buffett and the Business of Life” by Alice Schroeder: This comprehensive and authorized biography offers an intimate look at Buffett’s life, from his childhood to his unparalleled success. It delves into his investment strategies, business decisions, and personal philosophies.

- “Tap Dancing to Work: Warren Buffett on Practically Everything, 1966-2012” edited by Carol J. Loomis: A collection of insightful articles and essays written by or about Buffett, providing a deeper understanding of his thinking on various financial and business topics.

Peter Lynch Biography: Uncovering the Secrets of a “Superstar” Investor

Peter Lynch, the legendary manager of the Fidelity Magellan Fund, delivered astonishing returns by employing a “invest in what you know” strategy. His biographies offer practical advice and an engaging perspective on stock picking.

Key Takeaways from Lynch’s Life:

- Investing in Familiar Companies: Learn how to identify potential investment opportunities in everyday products and services.

- The Importance of Fundamental Analysis: Understand how to research and evaluate companies before investing.

- Turning Over Rocks: Discover the value of diligent research and uncovering hidden gems in the market.

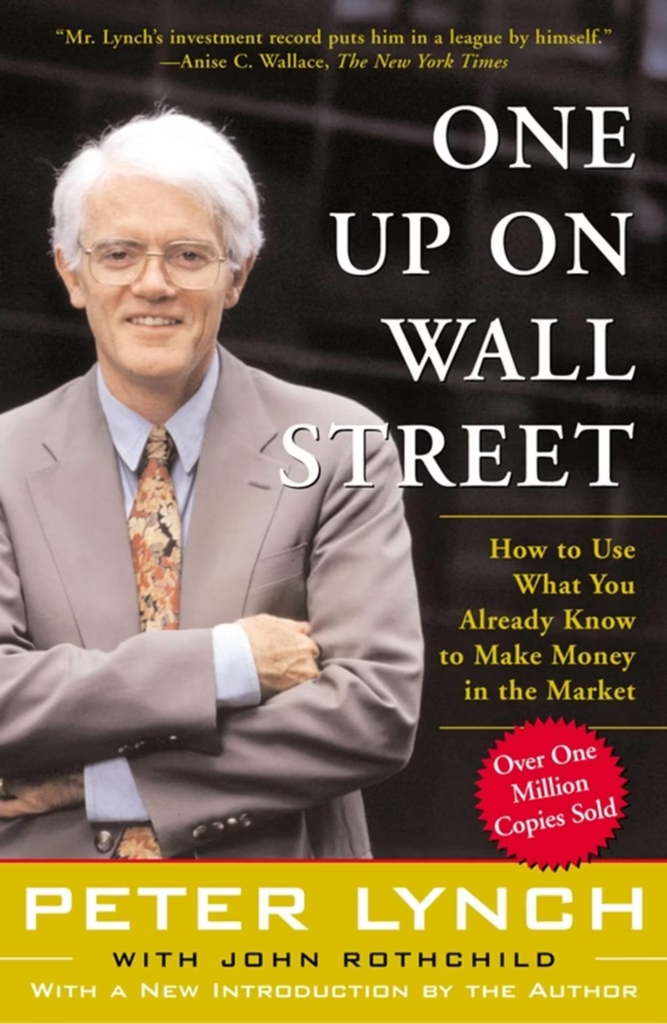

Essential Biographies of Peter Lynch:

- “One Up On Wall Street: How To Use What You Already Know To Make Money In The Market” by Peter Lynch with John Rothchild: While technically an investment guide, this book is deeply autobiographical, sharing Lynch’s personal experiences and strategies in a highly accessible way. It’s filled with anecdotes and practical advice drawn from his remarkable career.

- “Beating the Street” by Peter Lynch with John Rothchild: This follow-up book provides further insights into Lynch’s investment philosophy, offering guidance on portfolio management and navigating market volatility, again interwoven with his personal experiences.

More Legendary Investors: Expanding Your Financial Wisdom

Beyond Buffett and Lynch, the world of finance is filled with other remarkable individuals whose stories offer valuable lessons. While dedicated biographies might be less prevalent for some, exploring their philosophies and approaches through other books and resources can be incredibly beneficial. Consider looking into figures like:

- Benjamin Graham: The “father of value investing” and Buffett’s mentor. His book “The Intelligent Investor” remains a cornerstone of value investing principles.

- George Soros: A master of macro investing and understanding global economic trends. His book “The Alchemy of Finance” offers insights into his unique approach.

- John Templeton: A pioneer of global investing and a proponent of long-term, value-oriented strategies.

Learning from the Giants: Applying Their Wisdom to Your Finances

Reading the biographies of legendary investors is more than just learning about their past successes. It’s about understanding their mindset, their decision-making processes, and the principles that guided them through various market cycles. By studying their journeys, you can gain valuable insights to:

- Develop a long-term investment perspective.

- Improve your stock picking and analysis skills.

- Cultivate patience and discipline in your investment strategy.

- Understand the importance of continuous learning in the financial world.

Investing can be a rewarding journey, and learning from the experiences of those who have achieved extraordinary success is a powerful way to navigate the path to your own financial goals. Pick up one of these biographies and start unlocking the wisdom of the investing legends today!