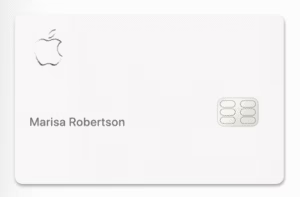

When Apple launched its credit card in 2019, it did so with the typical Apple fanfare: a sleek design, a revolutionary user interface, and a promise to simplify and reinvent the credit card experience. Issued by Goldman Sachs, the Apple Card broke the mold with its numberless titanium design, deep integration with the iPhone’s Wallet app, and a focus on transparency and user privacy. But now, years after its debut, the initial hype has settled. The question for consumers in 2025 is no longer just “What is the Apple Card?” but a more practical one: “Is the Apple Card actually good?”

The answer is complex. The Apple Card excels in certain areas, offering an unparalleled user experience and a straightforward cash-back program. For die-hard Apple enthusiasts and those new to credit, it can be a fantastic choice. However, for seasoned credit card rewards maximizers, its earning potential might feel limited compared to other top-tier cash-back cards on the market.

This in-depth review will cut through the marketing and analyze the real-world value of the Apple Card. We’ll explore its innovative features, break down its rewards structure, weigh its significant pros against its notable cons, and help you determine if this beautifully designed piece of titanium deserves a permanent spot in your digital and physical wallet.

How Does the Apple Card’s Daily Cash Back Actually Work?

The cornerstone of the Apple Card’s rewards program is “Daily Cash.” Unlike traditional credit cards that make you wait until the end of your billing cycle to receive your rewards, the Apple Card deposits your cash back into your Apple Cash account every single day. This instant gratification is a major selling point, making your rewards feel more tangible and immediately usable. You can use your Daily Cash to make purchases, send money to friends via iMessage, or transfer it to your bank account.

The earning rates are straightforward and tiered based on how you pay:

- 3% Daily Cash Back: This is the highest tier, earned on purchases made directly from Apple (including the App Store, Apple Music, iCloud, and Apple hardware) and at a select list of partner merchants like Panera Bread, T-Mobile, Nike, and Exxon/Mobil gas stations when using Apple Pay.

- 2% Daily Cash Back: You earn an unlimited 2% cash back on every purchase you make using Apple Pay with your iPhone or Apple Watch.

- 1% Daily Cash Back: You earn 1% cash back when you use the physical titanium Apple Card or use your card number online where Apple Pay is not accepted.

This structure immediately highlights the card’s primary intention: it is designed to be used with Apple Pay. The 1% rate on the physical card is decidedly lackluster and can be easily beaten by numerous other no-annual-fee cards.

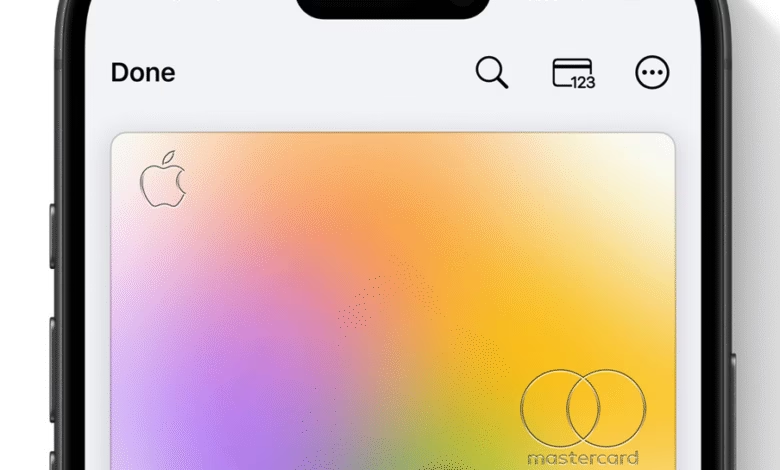

The User Experience: Why the Wallet App Integration is a Game-Changer

Arguably the single best feature of the Apple Card is its seamless integration with the iPhone’s Wallet app. This is where Apple’s renowned focus on user experience truly shines and sets it apart from every other credit card on the market.

- Real-Time Tracking and Categorization: Every transaction appears in the Wallet app almost instantly, automatically categorized by color codes (e.g., orange for food and drinks, pink for entertainment). This provides an incredibly clear and visually intuitive overview of your spending habits without needing a separate budgeting app.

- Transaction Mapping: Confused by a cryptic merchant name on your statement? The Apple Card uses Apple Maps to show you exactly where you made a purchase, eliminating the guesswork.

- Transparent Interest Calculation: The card’s payment interface is designed to educate. It features a dynamic wheel that allows you to see exactly how much interest you will pay based on the payment amount you choose. It actively encourages you to pay more to reduce interest charges, a level of transparency rarely seen from credit card issuers.

- 24/7 Support via iMessage: Instead of calling a 1-800 number and waiting on hold, all customer service is handled directly through iMessage, providing a convenient and modern support experience.

The Apple Card Savings Account: A Powerful Perk for Building Wealth

A significant enhancement to the Apple Card ecosystem is the high-yield Savings account, also provided by Goldman Sachs. This feature allows you to automatically deposit your Daily Cash into a savings account that, as of late 2024 and early 2025, offers a highly competitive Annual Percentage Yield (APY).

This creates a frictionless savings habit. The 2-3% you earn on purchases can be immediately put to work, earning interest and growing over time. You can also deposit additional funds from a linked bank account. The setup is effortless, managed entirely within the Wallet app, and there are no fees or minimum balance requirements. This feature transformed the Apple Card from just a spending tool into a powerful tool for saving and wealth-building, making it much more compelling.

What Are the Biggest Strengths of the Apple Card? (The Pros)

Let’s distill the key advantages of choosing the Apple Card.

- No Fees. Period: This is a massive selling point. The Apple Card has no annual fee, no foreign transaction fees, no late fees, and no over-the-limit fees. While late payments will still accrue interest and can be reported to credit bureaus, the absence of punitive penalty fees is a refreshing, consumer-friendly approach.

- Top-Notch Security and Privacy: The numberless physical card provides excellent security. To make an online purchase where Apple Pay isn’t available, you access a virtual card number within the secure Wallet app. Apple also emphasizes privacy, stating they don’t know what you bought, where you bought it, or how much you paid.

- Excellent for Apple Product Financing: The Apple Card offers 0% financing on new Apple products through “Apple Card Monthly Installments.” This allows you to spread the cost of a new iPhone, Mac, or iPad over several months, interest-free, all while still earning 3% Daily Cash back upfront on the entire purchase.

- Easy to Qualify For: Compared to other premium rewards cards, the Apple Card is known to have more lenient approval requirements, making it an excellent first credit card for students or those who are new to credit and looking to build their history.

Where Does the Apple Card Fall Short? (The Cons)

Despite its strengths, the card has several notable drawbacks, especially for more experienced users.

- Weak Rewards Outside of Apple Pay: The 2% cash back on all Apple Pay purchases is good, but the 1% rate on the physical card is subpar. Many flat-rate cash-back cards offer 2% back on all purchases, regardless of the payment method.

- Limited 3% Categories: While the list of 3% partners has grown, it remains relatively small compared to cards with broad, rotating 5% categories (like the Chase Freedom Flex℠) or high-earning categories for everyday spending like groceries and gas (like the Blue Cash Preferred® from American Express).

- No Welcome Bonus: This is a major disadvantage. Nearly every major competitor offers a sign-up bonus, often worth $200 or more, after meeting an initial spending requirement. The Apple Card offers nothing for new cardmembers.

- Locked into the Apple Ecosystem: To get the most value from the card, you need to be an iPhone user. The seamless user experience and 2% cash-back rate are dependent on using Apple Pay.

- Lack of Travel Protections: The Apple Card offers virtually no travel benefits. It lacks common perks like rental car insurance, trip delay reimbursement, or baggage delay insurance that are standard on many other no-annual-fee cards.

The Final Verdict: Who is the Apple Card Actually Good For in 2025?

After weighing the pros and cons, a clear picture emerges of the ideal Apple Card user.

The Apple Card is an excellent choice for:

- Devoted Apple Users: If you live and breathe the Apple ecosystem, buy Apple products regularly, and use Apple Pay for the majority of your transactions, this card is tailor-made for you.

- Those New to Credit: The lack of fees, transparent interface, and relatively easy approval make it a fantastic and educational first credit card for building credit history responsibly.

- Simplicity Seekers: If you hate tracking rotating categories, paying annual fees, and just want a simple, secure, and easy-to-manage card that integrates perfectly with your iPhone, the Apple Card is a winner.

- Anyone Wanting to Automate Savings: The high-yield Savings account feature is a standout perk that can help you effortlessly build an emergency fund or save for a goal.

However, you should probably look elsewhere if:

- You are a Rewards Maximizer: You can earn significantly more cash back or travel points with other cards that offer higher rates on your specific spending categories (e.g., dining, groceries, travel).

- You Don’t Use Apple Pay Often: If you frequently shop at places that don’t accept Apple Pay, the card’s value plummets, as you’ll be stuck earning a meager 1%.

- You Want a Big Welcome Bonus: You can easily get $200 or more in value from a competitor’s sign-up bonus, which the Apple Card completely lacks.

- You are a Frequent Traveler: The absence of travel insurance and other related perks makes it a poor choice for your primary travel card.

Ultimately, the Apple Card isn’t trying to be the best rewards card for everyone. It’s a beautifully designed financial tool that prioritizes user experience, simplicity, and security above all else. For its target audience, it’s not just good—it’s brilliant. But for the hardcore points-and-miles strategist, its shine is easily outmatched by more lucrative, albeit more complex, options.