10 Best Investment Strategies for Beginners

Discover some investment strategies for your money

Starting your investment journey can feel overwhelming. With so much information out there and countless options, it’s easy to get lost. But the good news is you don’t need to be a finance guru to begin building wealth. The key is to start with simple, proven strategies that prioritize long-term growth and risk management. This guide will introduce you to 10 of the best investment strategies designed specifically for beginners, helping you confidently take your first steps toward a secure financial future.

Why Start Investing Early? The Magic of Compounding

Before we dive into strategies, let’s quickly touch on the most important reason to start investing now: compounding. Compounding is essentially earning returns on your initial investment and on the accumulated returns from previous periods. It’s like a snowball rolling down a hill, getting bigger and faster as it goes. The longer your money is invested, the more powerful compounding becomes. Even small, consistent investments made early can grow into substantial wealth over decades.

Foundational Strategies: Building Your Investment Base

These strategies are fundamental for any beginner and form the bedrock of a healthy investment portfolio.

1. Pay Yourself First: Automate Your Savings

This is arguably the most crucial strategy. Before you pay bills or spend on discretionary items, allocate a portion of your income directly to your investments. Set up automatic transfers from your checking account to your investment account each payday. This ensures consistency, eliminates the temptation to spend the money, and leverages dollar-cost averaging (Strategy #4).

2. Invest in Low-Cost Index Funds and ETFs: Instant Diversification

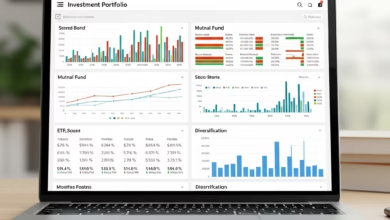

Instead of trying to pick individual winning stocks (which is very difficult even for experts), invest in low-cost index funds or Exchange-Traded Funds (ETFs). These are baskets of hundreds or thousands of different stocks or bonds that track a specific market index (like the S&P 500).

- Pros: Instant diversification, very low fees, historically strong long-term returns.

- Cons: You won’t “beat the market” (but most active managers don’t either!).

3. Diversify Your Portfolio: Don’t Put All Eggs in One Basket

Diversification means spreading your investments across different asset classes (like stocks and bonds), industries, company sizes, and geographies. If one investment performs poorly, another might do well, balancing out your overall returns. Low-cost index funds (Strategy #2) are excellent for achieving this naturally.

- Pros: Reduces risk, smooths out returns, positions you for various market opportunities.

- Cons: Can limit extreme gains if one specific investment skyrockets.

4. Practice Dollar-Cost Averaging: Smooth Out Market Volatility

This strategy involves investing a fixed amount of money at regular intervals (e.g., $100 every month), regardless of whether the market is up or down. When prices are high, your fixed amount buys fewer shares; when prices are low, it buys more shares. Over time, this averages out your purchase price.

- Pros: Reduces the impact of short-term market fluctuations, takes emotion out of investing, promotes consistent savings.

- Cons: You won’t necessarily buy at the absolute lowest price every time.

5. Understand Your Risk Tolerance and Time Horizon: Know Thyself

Before investing, ask yourself: How comfortable are you with the value of your investments going up and down? How long until you need the money?

- High Risk Tolerance/Long Time Horizon (e.g., 20+ years to retirement): You can generally allocate more to growth-oriented assets like stocks.

- Low Risk Tolerance/Short Time Horizon (e.g., 5 years to a house down payment): You might prefer more stable investments like bonds or high-yield savings accounts.

- Pros: Helps you create a portfolio that aligns with your comfort level and goals, reducing stress.

- Cons: Underestimating your risk tolerance can lead to panic selling; overestimating can lead to missed growth opportunities.

Growth-Oriented Strategies: Aiming for Long-Term Wealth

These strategies build upon the foundational ones to further optimize your portfolio for growth.

6. Focus on Long-Term Growth: Avoid Short-Term Speculation

For beginners, trying to make quick money through daily trading or speculating on “hot” stocks is highly risky and often leads to losses. Instead, focus on investing in quality assets with a strong potential for growth over many years. Think decades, not months.

- Pros: Leverages compounding, reduces stress from market noise, aligns with historical market performance.

- Cons: Requires patience and discipline.

7. Rebalance Your Portfolio Periodically: Maintain Your Target Mix

Over time, some of your investments will grow faster than others, throwing off your desired asset allocation (your mix of stocks, bonds, etc.). Rebalancing means periodically (e.g., once a year) selling some of your overperforming assets and buying more of your underperforming ones to bring your portfolio back to its target percentages.

- Pros: Helps manage risk, ensures you’re not overexposed to one area, can subtly encourage “buying low and selling high.”

- Cons: Requires active attention (even if just once a year), might incur minor transaction costs.

8. Invest in Tax-Advantaged Retirement Accounts: Boost Your Returns

Utilize accounts like 401(k)s, 403(b)s, and IRAs (Individual Retirement Accounts) first. These accounts offer significant tax benefits that can dramatically boost your long-term returns.

- 401(k)/403(b): Often offer employer matching contributions (free money!) and pre-tax contributions.

- Traditional IRA: Contributions might be tax-deductible; growth is tax-deferred.

- Roth IRA: Contributions are after-tax, but qualified withdrawals in retirement are tax-free.

- Pros: Major tax savings, potential for employer matching, powerful compounding.

- Cons: Money is typically locked until retirement age without penalty.

Smart Habits for Sustainable Investing: Beyond the Portfolio

These strategies are about your approach and continuous learning.

9. Continuously Educate Yourself: Stay Informed, Not Overwhelmed

The world of finance is vast, but you don’t need to know everything at once. Read reputable financial blogs, books, and articles. Focus on understanding the basics, market cycles, and how your chosen investments work. Avoid sensational headlines and get-rich-quick schemes.

- Pros: Empowers you to make better decisions, builds confidence, helps you adapt to market changes.

- Cons: Can be time-consuming, requires discerning reliable information.

10. Avoid Emotional Decisions: Stick to Your Plan

Market downturns can be scary, and market rallies can tempt you to chase “hot” investments. Resist the urge to make impulsive decisions based on fear or greed. Stick to your long-term investment plan, which should be based on your goals and risk tolerance, not daily market noise.

- Pros: Prevents costly mistakes, leads to more consistent long-term returns, reduces investment-related stress.

- Cons: Requires significant discipline and emotional control, especially during volatile times.

Your Journey Begins Now: The Power of Consistency

Embarking on your investment journey with these 10 strategies will set you on a strong path. Remember, investing is a marathon, not a sprint. Start small, be consistent, stay diversified, and focus on the long term. The most powerful investment you can make is in your financial education and consistent action. Your future self will thank you.