Passive or active investing, which is right for you?

What type of investment should I choose?

When you start your investment journey, you’ll quickly encounter two main approaches: passive investing and active investing. These strategies sit at opposite ends of the spectrum, each with its own philosophy, benefits, and drawbacks. Understanding the core differences between them is crucial for choosing the path that best aligns with your financial goals, time commitment, and investing style. This guide will break down passive and active investing, helping you decide which strategy is ideal for you.

Understanding the Core Philosophies: Set It and Forget It vs. Beat the Market

At their heart, passive and active investing represent different beliefs about how financial markets work and how best to achieve returns.

Passive Investing: The “Set It and Forget It” Approach

Passive investing is based on the belief that it’s very difficult, if not impossible, to consistently “beat the market” over the long term. Instead, passive investors aim to match the market’s performance. They do this by investing in funds that track a specific market index, like the S&P 500 (which represents 500 of the largest U.S. companies) or a global bond index.

The philosophy here is simplicity, low cost, and long-term growth. Passive investors generally buy and hold these index funds, making minimal trades and letting their investments grow with the overall economy. It’s often referred to as a “buy and hold” strategy.

Active Investing: The Quest to “Beat the Market”

Active investing, on the other hand, is driven by the goal of outperforming the market. Active investors believe that through diligent research, skilled stock picking, and well-timed trades, they can achieve returns higher than what a broad market index provides.

This strategy involves more frequent buying and selling decisions, whether it’s individual stocks, bonds, or actively managed mutual funds where professional managers make the investment choices. Active investors spend significant time analyzing financial statements, market trends, economic indicators, and company news to identify opportunities they believe the market has mispriced.

Passive Investing: The Benefits of Simplicity and Lower Costs

Passive investing has gained immense popularity, and for good reason. It offers several compelling advantages, especially for everyday investors.

Lower Fees and Expenses: More Money Stays in Your Pocket

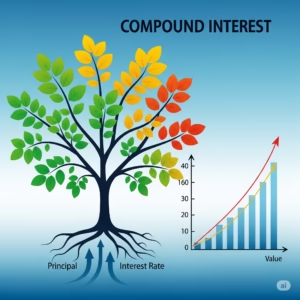

One of the biggest advantages of passive investing is its significantly lower costs. Index funds and ETFs (Exchange-Traded Funds) that track an index typically have very low expense ratios, meaning a smaller percentage of your investment goes towards management fees. Actively managed funds, which require fund managers to conduct extensive research and make trades, charge higher fees. Over decades, these seemingly small fee differences can amount to tens of thousands of dollars in your favor.

Diversification by Design: Reducing Risk

Index funds offer instant diversification. When you invest in an S&P 500 index fund, for example, you’re immediately invested in 500 different companies across various industries. This broad diversification helps reduce specific company risk (the risk that one particular stock performs poorly) because the performance of any single company has a minimal impact on your overall portfolio.

Less Time and Effort: Ideal for Busy Investors

Passive investing is incredibly time-efficient. Once you set up your investments in index funds or ETFs, there’s little ongoing management required. You don’t need to spend hours researching companies or tracking market news. This “set it and forget it” approach makes it ideal for busy individuals who want to invest for their future without it consuming their free time.

Consistent Market Returns: Long-Term Growth Potential

While passive investing won’t make you a millionaire overnight, it consistently delivers market-level returns. Over the long history of financial markets, broad indexes have shown significant growth over time, allowing patient investors to compound their wealth steadily. For retirement planning, this consistent, reliable growth is often exactly what’s needed.

Active Investing: The Allure of Higher Returns (and Higher Risks)

Active investing appeals to those who believe they have the skill or insight to outperform the market. While challenging, it does offer some potential benefits.

Potential for Higher Returns: The “Outperformance” Dream

The primary motivation for active investing is the possibility of generating returns that exceed the broader market. If an active investor or fund manager makes shrewd decisions, identifies undervalued assets, or successfully navigates market downturns, they can achieve superior returns. This potential for higher gains is what draws many to this strategy.

Flexibility and Adaptability: Responding to Market Shifts

Active managers have the flexibility to adjust their portfolios based on changing market conditions, economic forecasts, or specific company news. If they anticipate a downturn in a particular sector, they can reduce exposure, or if they identify a promising new trend, they can invest aggressively. This agility is a key difference from the static nature of passive index funds.

Deeper Understanding of Investments: For the Engaged Investor

For those who enjoy the process of research and analysis, active investing can be intellectually stimulating. It provides an opportunity to delve deeply into companies, industries, and economic data. This hands-on approach can lead to a more profound understanding of the financial world.

The Trade-offs: What You Give Up

Both strategies come with their own trade-offs.

The Challenges of Active Investing: Fees and Underperformance

Despite the allure, consistently beating the market is incredibly difficult. Studies have shown that the vast majority of actively managed funds underperform their passive benchmarks over the long term, especially once their higher fees are taken into account. The effort required for active investing can be substantial, and the psychological toll of potential losses can be significant.

The Limitation of Passive Investing: No “Outperformance”

The main “downside” of passive investing is that by definition, you will only match the market, not beat it. While this means you avoid underperformance, it also means you won’t experience the thrill of picking a winning stock that dramatically outperforms. For some investors, this lack of potential for extraordinary gains might feel limiting.

Which is Right for You? A Decision Tree

Choosing between passive and active investing depends on several factors:

- Your Time and Interest: Do you enjoy researching companies and following market news? If not, passive investing is likely a better fit.

- Your Risk Tolerance: While both involve market risk, active investing adds the risk of poor stock selection or timing. Are you comfortable with potentially greater volatility and the possibility of underperforming the market?

- Your Financial Goals: Are you aiming for reliable, consistent market returns for long-term goals like retirement, or are you hoping to achieve aggressive, short-term gains (which comes with higher risk)?

- Your Belief in Market Efficiency: Do you believe markets are generally efficient and it’s hard to find mispriced assets, or do you think opportunities to consistently outperform are abundant?

For most individual investors, especially those new to investing or focused on long-term goals like retirement, a predominantly passive approach is often recommended. It’s cost-effective, diversified, and requires minimal time.

However, you don’t have to choose just one. Many investors adopt a hybrid approach, where the core of their portfolio is passively managed through low-cost index funds, and a smaller portion is allocated to active investments (e.g., individual stocks they’ve researched, or a niche actively managed fund) for those who enjoy the challenge and potential upside.

Ultimately, the best strategy is the one you understand, can stick with, and that helps you achieve your financial objectives with peace of mind.