Investments

Clearing your doubts and helping you invest your capital in REITs

Complete guide on Real Estate investments

Investing in US real estate has long been a popular choice for individuals seeking to diversify their portfolios and generate passive income. With its vast and diverse market, the US offers a wide range of real estate investment opportunities. This guide will explore the various aspects of US real estate investing, from the basics to more advanced strategies.

Types of US Real Estate Investments

- Residential Real Estate:

- Single-family homes: Buying and renting out single-family homes is one of the most common forms of residential real estate investing.

- Multi-family properties: Investing in apartment buildings, duplexes, or triplexes can provide a steady stream of rental income.

- Commercial Real Estate:

- Office buildings: Investing in office buildings can offer high rental yields, but it also comes with higher risks.

- Retail properties: Investing in retail properties can be a good option if you can find properties in growing areas.

- Industrial properties: Investing in industrial properties can be a good choice for long-term appreciation.

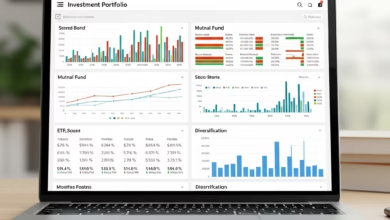

- Real Estate Investment Trusts (REITs):

- REITs are companies that own and operate income-generating real estate.

- Investing in REITs allows you to participate in real estate without directly owning property.

Benefits of US Real Estate Investing

- Potential for high returns: Real estate can appreciate in value over time, generating significant capital gains.

- Passive income: Rental income can provide a steady stream of cash flow.

- Tax benefits: Real estate investments often offer various tax advantages, such as depreciation deductions.

- Hedge against inflation: Real estate values tend to increase with inflation.

Risks of US Real Estate Investing

- Economic downturns: Real estate markets can be volatile and are susceptible to economic cycles.

- Vacancy rates: If your property remains vacant, you may face financial difficulties.

- Property management: Managing rental properties can be time-consuming and stressful.

- Local market conditions: The performance of your investment can be affected by local market conditions.

How to Get Started

- Educate yourself: Learn about the different types of real estate investments and the local market.

- Create a financial plan: Determine your investment goals and risk tolerance.

- Build a team: Assemble a team of professionals, including a real estate agent, a lender, and an attorney.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different properties and markets.

Investing in US real estate can be a rewarding experience, but it’s important to approach it with caution and do your due diligence. By understanding the different types of investments, the potential benefits and risks, and by taking the necessary steps to get started, you can increase your chances of success.